Aimco Files Definitive Proxy Materials and Mails Letter to Stockholders

Urges Stockholders to Use Universal WHITE Proxy Card to Vote “FOR ALL” Three of the Company’s Nominees, Jay Paul Leupp, Michael A. Stein and R. Dary Stone

DENVER--(BUSINESS WIRE)--Apartment Investment and Management Company (NYSE: AIV) (“Aimco” or the “Company”), today announced that it has filed its definitive proxy materials with the Securities and Exchange Commission (“SEC”) in connection with its 2022 Annual Meeting of Stockholders scheduled to be held on December 16, 2022. Stockholders of record as of October 26, 2022, will be entitled to vote at the meeting. Aimco’s Board of Directors (the “Board”) strongly recommends that stockholders vote on the WHITE proxy card "FOR ALL" three of Aimco’s qualified and experienced director nominees, Jay Paul Leupp, Michael A. Stein and R. Dary Stone.

In conjunction with the definitive proxy filing, Aimco has also mailed a letter to the Company’s stockholders. Highlights from the letter include:

- Aimco has implemented a clearly defined value creation strategy and a comprehensive transformation of the Company’s legacy business under the leadership of a reconstituted Board and new executive management team.

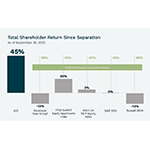

- Since the December 2020 spin-off of Apartment Income REIT Corp., Aimco has delivered total stockholder returns of 45%1, significantly outperforming its identified developer peer group2, the FTSE NAREIT Equity Apartments Index, the MSCI US REIT Index, the S&P 500, and the Russell 2000.

- The Company’s new, majority-independent and reconstituted Board possesses highly relevant experience and complementary skillsets to oversee its growth strategy.

- Aimco’s Board and management team are focused on the future and have a clear plan to build on the Company’s progress and continue to drive growth and outsized returns.

- The Aimco Board believes that the election of Land & Buildings’ candidates would remove expertise from the Aimco Board that is critical to the Company’s success.

Aimco’s definitive proxy materials and other materials regarding the Board’s recommendation for the 2022 Annual Meeting of Stockholders can be found at https://investors.aimco.com.

1 TSR calculation as of September 30, 2022

2 Includes AHH, CLPR, CSR, FOR, FPH, HHC, IRT, JBGS, JOE, STRS, TRC, VRE, and WRE (per AIV 2021 10-K) represents simple average

The full text of the letter being mailed to stockholders follows:

October 12, 2022

Dear Fellow Stockholders:

Your Board of Directors and management team are committed to enhancing the value of your investment in Aimco and have been unwavering in our commitment to acting in the best interests of our stockholders. We have implemented a clearly defined value creation strategy and a comprehensive transformation of Aimco’s legacy business under a recently reconstituted, majority-independent Board (the “New Aimco Board” or the “Board”) and all-new executive management team.

Since the New Aimco Board and management team assumed their current roles following the Apartment Income REIT Corp. (“AIR”) spin-off in December 2020, Aimco has delivered total stockholder returns of 45%3, significantly outperforming its identified developer peer group4, the FTSE NAREIT Equity Apartments Index, the MSCI US REIT Index, the S&P 500 and the Russell 2000.

Aimco expects to continue to drive growth and outsized returns by:

- Executing on its deep pipeline of real estate development opportunities in targeted high growth markets, investing when conditions are right and monetizing when advantageous.

- Practicing disciplined capital allocation, directing capital to additional, multifamily-focused, real estate investments and acquiring Aimco shares opportunistically.

- Funding investments through the recycling of Aimco equity and through joint venture partnerships.

- Continuing to simplify the Aimco business through increasingly focused capital and geographic allocation.

The New Aimco Board and new management team executing this plan were put in place in connection with the 2020 spin-off of AIR, with the Company:

- Appointing six new Aimco directors to replace resigning members of the prior Board, after a thorough search process assisted by a leading executive and board search firm with deep expertise in the real estate industry. As a result, six of Aimco’s eight independent directors have been added within the past two years. Aimco also retained three directors with complementary skillsets and important historical knowledge of Aimco’s business operations;

- Appointing a new chief executive officer, chief financial officer and general counsel to replace the prior pre-spin management team; and

- Separating Aimco’s Board chair and CEO positions and appointing a new chairman of the Board.

Despite Aimco’s clear momentum and the recent reconstitution of the Aimco Board, Land & Buildings Investment Management LLC (“Land & Buildings”) has initiated a proxy contest and is seeking to remove and replace two of your highly qualified directors. We have engaged with Land & Buildings to better understand its perspectives and have reviewed the qualifications of the candidates it has put forth. It is clear from our interactions to date, however, that Land & Buildings is primarily focused on historical issues and decisions made prior to the reconstitution of the Aimco Board and the replacement of the Aimco management team. While the New Aimco Board and management are open to continued dialogue with Land & Buildings, we believe that additional director turnover at this time is unwarranted. We also believe that the candidates proposed by Land & Buildings would not bring any relevant expertise that is not already well represented on the Aimco Board, and that election of Land & Buildings’ candidates would remove expertise from the New Aimco Board that is critical to our success.

Against this backdrop, you now face an important decision regarding the future of your investment and go-forward Board of Directors. Your Board has three directors up for re-election who have highly relevant skills and expertise and are important contributors to Aimco’s ongoing success. To protect your investment, we strongly recommend that you vote the enclosed universal WHITE proxy card today “FOR” all three of Aimco’s qualified and experienced director nominees: Jay Paul Leupp, Michael A. Stein and R. Dary Stone. Please vote today to ensure your voice is heard at the Company’s Annual Meeting of Stockholders (“Annual Meeting”) on December 16, 2022.

PROTECT THE VALUE OF YOUR INVESTMENT.

USE THE UNIVERSAL WHITE PROXY CARD TODAY TO VOTE FOR ALL THREE

OF AIMCO’S QUALIFIED AND EXPERIENCED DIRECTORS

AIMCO IS SUCCESSFULLY EXECUTING ITS VALUE ADD STRATEGY

For the past 21 months, Aimco has been successfully executing a growth strategy focused on value add, opportunistic, and alternative investments, targeting the U.S. multifamily sector.

As part of this strategy, we’ve taken decisive actions to drive stockholder value, by:

- Creating $100 million of value from the monetization of successfully executed development and redevelopment projects;

- Securing significant, high-quality, future development opportunities, more than tripling Aimco's controlled pipeline to a total potential of more than 15 million square feet, located in high-growth markets;

- Retiring or refinancing more than $1 billion of near-term liabilities, eliminating substantially all of our floating rate exposure;

- Entering into a strategic capital partnership with Alaska Permanent Fund Corporation providing core equity capital for up to $1 billion of Aimco-led multifamily development projects and creating the opportunity to earn third-party management fees and incentive income;

- Unlocking $265 million of asset value by selling three stabilized multifamily assets at prices above the values in Aimco’s internal Net Asset Value (“NAV”) estimate and by selling a partial interest in our passive minority investment in the life science developer, IQHQ, generating a greater than 50% internal rate of return;

- Eliminating various legacy entanglements with AIR through the early repayment of the $534 million purchase money note, the reduction of leasehold liabilities from $475.1 million down to $6.1 million, and the amendment of key provisions of the master leasing agreement with AIR;

- Acquiring approximately 742,164 Aimco shares at a weighted average price of $5.93 per share in the first half of 2022 and increasing the Company’s share repurchase authorization from 10 million to 15 million shares; and

- Building and maintaining a highly qualified and dedicated team of real estate investment professionals, achieving an all-time Company record employee engagement score of 4.52 out of 5, based on independent third-party surveys.

AIMCO HAS DELIVERED SIGNIFICANT VALUE FOR STOCKHOLDERS

Since the December 2020 spin-off, Aimco has significantly outperformed its identified developer peer group, real estate market indices, and broader market indices, as evidenced in the following chart.

From an operating perspective, we have generated significant value across our stabilized portfolio and our development pipeline. For example, during the first half of 2022, we increased net operating income by 14.9%, and since the start of 2021, we have nearly tripled the Company’s future development pipeline.

Importantly, we have a clear plan to build on this progress and drive continued growth. We will remain primarily focused on multifamily housing with an increased allocation to value add and opportunistic investments. We will also continue to leverage the Company’s best-in-class platform, existing portfolio of value add and stable core properties, and an investment pipeline that leads to superior risk-adjusted returns.

Despite these strong results and clear and actionable strategy, the New Aimco Board is not standing still. We routinely consider all viable options to enhance and unlock stockholder value and remain committed to doing so going forward.

NEW AIMCO BOARD AND MANAGEMENT TEAM HAVE ENGAGED CONSTRUCTIVELY

WITH STOCKHOLDERS, INCLUDING LAND & BUILDINGS

Aimco is committed to open and constructive engagement with all stockholders, including Land & Buildings. Aimco has held more than 80 individual meetings with more than 35 current and prospective stockholders in the past 13 months, including stockholders that own in the aggregate more than 80% of Aimco’s outstanding shares of common stock, as well as multiple meetings with Land & Buildings, as described in the Company’s proxy statement. The New Aimco Board has demonstrated that we value and act on the feedback we receive.

The New Aimco Board and management team are focused on the future, executing a clear and effective strategy to enhance the value of your investment, while Land & Buildings’ complaints primarily relate to decisions made almost two years ago by the pre-spin Board of Directors and management team.

THE DIRECTORS ON AIMCO’S MAJORITY-INDEPENDENT, RECONSTITUTED BOARD

BRING HIGHLY RELEVANT SKILLS AND FRESH PERSPECTIVES

Aimco is seeking your support to vote FOR ALL of its three highly qualified, experienced directors at this year’s Annual Meeting: Jay Paul Leupp, Michael A. Stein and R. Dary Stone.

The New Aimco Board is purpose-built, and its composition reflects our commitment to closely aligning the skill sets and experience of the Company’s directors with the needs of the Company and its stockholders. Importantly, the Board works closely with management and has been—and will continue to be—a significant agent of change overseeing the continued improvement of Aimco’s performance and valuation.

We are confident that our three highly-qualified nominees seeking re-election are the better choice to build on the success that Aimco has delivered. Aimco’s three director nominees bring highly relevant expertise and complementary skillsets, and our Board is unanimous in recommending that stockholders vote for our three nominees.

Mr. Leupp, an independent director and the Chairman of Aimco’s Audit Committee, has been an integral part of our Board since his appointment in December 2020 and brings capital markets, investment and finance, real estate, and development experience gained through his over 28 years as a Portfolio Manager and Managing Director focused on investments in publicly traded real estate securities and publicly traded REIT board service. Mr. Leupp is a Certified Public Accountant (CPA).

- Current Managing Partner and Senior Portfolio Manager, Real Estate Securities, Terra Firma Asset Management.

- Previously served as the Managing Director and Portfolio Manager/Analyst, Global Real Estate Securities, Lazard Asset Management. Prior to Lazard, was the lead equity research analyst at Royal Bank of Canada and at Robertson Stevens & Co.

- Currently serves on the board of directors of Health Care Realty and Marathon Digital Holdings.

- Currently a member of Aimco’s Compensation and Human Resources, Nominating, Environmental, Social, and Governance, Investment, and Aimco-AIR Transactions Committees, in addition to serving as Chairman of the Audit Committee.

Mr. Stein, an independent director and Chairman of Aimco’s Investment Committee, is a seasoned executive who brings real estate investment and finance, financial reporting, accounting and auditing, capital markets, and business operations experience, gained through his experience as a director of five publicly traded companies and Chief Financial Officer of three publicly traded companies. Further, having served on Aimco’s Board since October 2004, Mr. Stein has significant institutional knowledge of Aimco.

- Served as Senior Vice President and Chief Financial Officer of ICOS Corporation, a biotechnology company based in Bothell, Washington from January 2001 until its acquisition by Eli Lilly in January 2007.

- Previously served as Executive Vice President and Chief Financial Officer of Nordstrom, Inc. and served in various capacities with Marriott International, Inc., including Executive Vice President and Chief Financial Officer.

- Currently a member of Aimco’s Audit, Compensation and Human Resources, and Nominating, Environmental, Social, and Governance Committees, in addition to serving as Chairman of the Investment Committee.

Mr. Stone, an independent director and Chairman of Aimco’s Nominating, Environmental, Social, and Governance Committee, is an experienced leader and has served on Aimco’s Board since December 2020 and brings investment and finance, real estate, development, property / asset management and operations, and capital markets experience gained through his over 30-year career investing and developing a variety of projects and joint ventures, including the management of one of the country’s largest master planned developments. He also brings publicly traded REIT board service.

- Accomplished executive who served as President of multiple real estate development companies and ultimately as President and Chief Operating Officer of Cousins Properties, an NYSE listed REIT.

- Currently a member of the board of directors of Cousins Properties and Audit Chairman of Tolleson Wealth Management, a privately held wealth management firm, and Tolleson Private Bank.

- Former Chairman of Baylor University Board of Regents and Chairman of the Banking Commission of Texas (previously known as the Texas State Finance Commission).

- Currently a member of Aimco’s Audit, Compensation and Human Resources, and Investment Committees, in addition to serving as Chairman of the Nominating, Environmental, Social, and Governance Committee.

PROTECT THE VALUE OF YOUR INVESTMENT AND AIMCO’S FUTURE GROWTH PROSPECTS.

USE THE UNIVERSAL WHITE PROXY CARD TODAY TO VOTE FOR ALL THREE

OF AIMCO’S QUALIFIED AND EXPERIENCED DIRECTORS

The New Aimco Board is active, engaged and focused on continuing to grow Aimco and providing enhanced value for all our stockholders. We strongly recommend that stockholders vote FOR the Company’s three director nominees on the universal WHITE proxy card: Jay Paul Leupp, Michael A. Stein and R. Dary Stone.

Your vote “FOR” our director nominees will help ensure that you, as an Aimco stockholder, have a Board acting in your best interest at all times.

On behalf of the New Aimco Board, we appreciate your investment and support.

Sincerely,

The Aimco Board of Directors

3 TSR calculation as of September 30, 2022

4 Includes AHH, CLPR, CSR, FOR, FPH, HHC, IRT, JBGS, JOE, STRS, TRC, VRE, and WRE (per AIV 2021 10-K) represents simple average

If you have questions or require any assistance with voting your shares, please contact the Company’s proxy solicitor listed below:

MacKenzie Partners, Inc.

1407 Broadway, 27th Floor

New York, New York 10018

Call Collect: (212) 929-5500

or

Toll-Free (800) 322-2885

Email: proxy@mackenziepartners.com

Forward Looking Statements

This document contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding our intent, belief, or expectations, including, but not limited to, the statements in this document regarding future financing plans, including the Company’s expected leverage and capital structure; business strategies, prospects, and projected operating and financial results (including earnings), including facts related thereto, such as expected costs; future share repurchases; expected investment opportunities; and our 2022 pipeline investments and projects. We caution investors not to place undue reliance on any such forward-looking statements.

Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “plan(s),” “may,” “will,” “would,” “could,” “should,” “seek(s),” “forecast(s),” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. These statements are not guarantees of future performance, condition or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, among others, that may affect actual results or outcomes include, but are not limited to: (i) the risk that the 2022 preliminary plans and goals may not be completed in a timely manner or at all, (ii) the inability to recognize the anticipated benefits of the pipeline investments and projects, and (iii) changes in general economic conditions, including as a result of the COVID-19 pandemic. Although we believe that the assumptions underlying the forward-looking statements, which are based on management’s expectations and estimates, are reasonable, we can give no assurance that our expectations will be attained.

Risks and uncertainties that could cause actual results to differ materially from our expectations include, but are not limited to: the effects of the coronavirus pandemic on the Company’s business and on the global and U.S. economies generally; real estate and operating risks, including fluctuations in real estate values and the general economic climate in the markets in which we operate and competition for residents in such markets; national and local economic conditions, including the pace of job growth and the level of unemployment; the amount, location and quality of competitive new housing supply; the timing and effects of acquisitions, dispositions, redevelopments and developments; changes in operating costs, including energy costs; negative economic conditions in our geographies of operation; loss of key personnel; the Company’s ability to maintain current or meet projected occupancy, rental rate and property operating results; the Company’s ability to meet budgeted costs and timelines, and, if applicable, achieve budgeted rental rates related to redevelopment and development investments; expectations regarding sales of apartment communities and the use of proceeds thereof; the ability to successfully operate as two separate companies each with more narrowed focus; insurance risks, including the cost of insurance, and natural disasters and severe weather such as hurricanes; financing risks, including the availability and cost of financing; the risk that cash flows from operations may be insufficient to meet required payments of principal and interest; the risk that earnings may not be sufficient to maintain compliance with debt covenants, including financial coverage ratios; legal and regulatory risks, including costs associated with prosecuting or defending claims and any adverse outcomes; the terms of laws and governmental regulations that affect us and interpretations of those laws and regulations; possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of apartment communities presently or previously owned by the Company; activities by stockholder activists, including a proxy contest; the Company’s relationship with each other after the consummation of the business separation; the ability and willingness of the Company and their subsidiaries to meet and/or perform their obligations under any contractual arrangements that are entered into among the parties in connection with the business separation and any of their obligations to indemnify, defend and hold the other party harmless from and against various claims, litigation and liabilities; and the ability to achieve some or all the benefits that we expect to achieve from the business separation.

In addition, the Company’s current and continuing qualification as a real estate investment trust involves the application of highly technical and complex provisions of the Internal Revenue Code and depends on the Company’s ability to meet the various requirements imposed by the Internal Revenue Code, through actual operating results, distribution levels and diversity of stock ownership.

Readers should carefully review the Company’s financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and in Item 1A of the Company’s Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2022 and June 30, 2022, and the other documents the Company files from time to time with the SEC. These filings identify and address important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

These forward-looking statements reflect management’s judgment as of this date, and the Company assumes no (and disclaims any) obligation to revise or update them to reflect future events or circumstances.

We make no representations or warranties as to the accuracy of any projections, estimates, targets, statements or information contained in this document. It is understood and agreed that any such projections, estimates, targets, statements and information are not to be viewed as facts and are subject to significant business, financial, economic, operating, competitive and other risks, uncertainties and contingencies many of which are beyond our control, that no assurance can be given that any particular financial projections or targets will be realized, that actual results may differ from projected results and that such differences may be material. While all financial projections, estimates and targets are necessarily speculative, we believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation.

Contacts

Matt Foster

Sr. Director, Capital Markets and Investor Relations

(303) 793-4661

investor@aimco.com

MacKenzie Partners, Inc.

Dan Burch

212-929-5748

Dburch@mackenziepartners.com

Matthew Sherman / Andrew Siegel / Greg Klassen

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449

Read full story here

Editor Details

-

Company:

- Businesswire