Masimo Board of Directors Sets the Record Straight on False and Misleading Claims

Responds and Corrects Politan’s Inaccurate Letter

Highlights Politan’s Reckless Disregard for the Truth and Fundamental Misunderstanding of Masimo’s Business

Strongly Encourages Stockholders to Protect Their Investment by Voting FOR H Michael Cohen and Julie Shimer, Ph.D., on the WHITE Proxy Card

IRVINE, Calif.--(BUSINESS WIRE)--The Masimo Corporation (“Masimo” or the “Company”) (Nasdaq: MASI) Board of Directors today issued a letter to stockholders to set the record straight on the many highly misleading and inaccurate claims recently published by Politan Capital Management (“Politan”). Politan’s reckless and unprincipled willingness to distort the truth in pursuit of its agenda shows its founder and nominee Quentin Koffey is not to be trusted to serve on Masimo’s Board of Directors. The Board continues to encourage stockholders to vote FOR Masimo’s highly qualified director nominees, H Michael Cohen and Julie Shimer, Ph.D., using the WHITE proxy card.

The full text of the Board’s letter to our stockholders can be found here:

Dear Fellow Masimo Shareholders:

In our prior letter, published on May 26, 2023, we wrote that Politan and its founder and nominee Quentin Koffey have shown a reckless disregard for the truth in pursuit of their dangerous agenda. We pointed out a handful of highly misleading and inaccurate statements that suggest Mr. Koffey is either purposely misleading or fundamentally ignorant of Masimo’s business, industry and history; however, the sheer number of errors in Politan’s May 23 letter requires its own letter to set the record straight. Below you will find a catalog of Politan’s falsehoods and inaccuracies.

Mr. Koffey’s choice to twist history, promote false narratives, take quotes out of context and cherry-pick data demonstrates how unprincipled and self-serving he has been in his engagement with Masimo. Mr. Koffey’s implication that there has been a rift between Masimo’s Board and management and its shareholders completely ignores the long-term mutual respect we have built with shareholders. Mr. Koffey’s behavior, including his costly scorched earth litigation against Masimo and its current and former Board members, is a warning of the risk of chaos and dysfunction he would create in Masimo’s boardroom and the potential destruction of value that could ensue for all shareholders.

There is no need for shareholders to take this risk. Masimo has a proven track record of identifying and executing on new opportunities to improve lives, improve patient outcomes and reduce the cost of care by taking noninvasive monitoring to new sites and applications. Masimo has consistently delivered above-market growth year after year, and trailblazed significant new markets through the development of highly differentiated technologies. Masimo has the right strategy for the future and has always had a Board representing its shareholders. When shareholders saw things differently, the Board has considered, respected and acted upon shareholders’ input. We strongly encourage you to put a stop to Mr. Koffey’s pursuit of his risky agenda by voting FOR Masimo’s highly qualified director nominees, H Michael Cohen and Julie Shimer, Ph.D., using the WHITE proxy card.

Thank you for your continued support,

Masimo Board of Directors

POLITAN FICTIONS(1) | FACTS |

“[W]e have nominated two ideally qualified individuals to the Board, Michelle Brennan and Quentin Koffey.” | Julie Shimer and Michael Cohen have a full understanding of Masimo’s business, with directly applicable experience and contacts that greatly benefit Masimo. In addition, our Nominating Committee has identified independent candidates through a retained search agency who also have directly applicable experience (consumer, payer/provider and government) to Masimo’s business. If shareholders approve the expansion of the Board, we will consider Ms. Brennan along with the other Board candidates and add the two best to Masimo’s Board.

On the other hand, Mr. Koffey is totally unqualified for the board of any medical technology company, much less Masimo’s Board.

|

“Despite our continual efforts over the past year to work privately and constructively with the Company, Masimo’s Board has demonstrated zero interest in good faith discussions.” | Masimo’s Board has repeatedly offered to work with Politan, including to identify and add to the Board two mutually agreeable directors who are independent of both Masimo and Politan. Politan refused unless we acquiesced to its demand that Mr. Koffey must be added to the Board. Politan has also refused to provide available dates for the Board to interview Michelle Brennan, Politan’s other nominee. In addition, on two separate occasions, Masimo invited Politan to meet with one of the independent directors. Politan declined the first invitation and did not respond to the second.

Further, Politan and Mr. Koffey have not privately offered any actionable or constructive recommendation or guidance for the Company other than demanding two board seats, including one for Mr. Koffey. Indeed, Mr. Koffey even predicated his views about the Company on its response to his demand, stating directly to the Company that he would be management’s “biggest cheerleader” if added to the Board and would wage a proxy contest against the Company if not. |

______________

(1) From Politan’s May 23, 2023 Letter to Masimo Shareholders.

Masimo’s Board has “aggressively us[ed] litigation in an attempt to force us to disclose commercially sensitive information and tr[ied] to identify and pressure Politan’s own investors.” | Politan sued Masimo, not the other way around. Once Politan sued Masimo, we sought discovery relevant to the claims and defenses in the litigation, including concerning Politan’s undisclosed financial backers and agreements and arrangements. Politan refused to provide discovery about its motivations, its plans and proposals for the Company, or its financial backers.(2)

Masimo reached out to one Politan investor, EnTrust Global, who Politan willingly disclosed in a Wall Street Journal article as backing its Masimo campaign. Masimo invited a discussion with EnTrust, which EnTrust declined after Politan sued Masimo. Thus, Masimo could not have “pressured” EnTrust.

The disclosure by Politan of its own investor in the Wall Street Journal was as follows: “A portion of Politan’s Masimo capital comes from EnTrust Global, the investment firm run by Gregg Hymowitz that backs many of activist investors’ biggest bets, people familiar with the matter said. This is the second campaign EnTrust worked with Politan on after Centene.” |

“Masimo’s efforts to enter adjacent markets have missed every target by over 50% ...”

“Masimo … has drastically missed any and all targets outside of SET.”

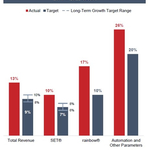

“Adjacent market efforts have missed every target by 50+%: At each of its investor days, held in 2012, 2017 and 2019, Masimo established revenue targets for non-SET products – targets it claimed were conservative at the time – and proceeded to miss every one of them by a wide mark.” | Masimo significantly outperformed its 2017 long-range revenue growth target of 8 to 10%, which included above-market growth targets for each of its major product categories (SET®, rainbow®, Hospital Automation and Other Parameters). Every major product category exceeded its growth target. See Figure 1.

At the 2019 investor day, Masimo provided an update on its actual performance against the long-range revenue growth target of 8 to 10%, which included revenue outperformance for SET® and rainbow® and in-line performance for other advanced parameters (NomoLine®, SedLine®, and O3®). |

“While the success of SET deserves admiration, it has not bestowed upon Masimo’s management team and CEO a Midas Touch or granted them immunity from market realities.” | Masimo’s management team and CEO have never claimed to have a Midas Touch or be immune from market realities. However, when the management team met with Mr. Koffey on September 2, 2022, Mr. Koffey insisted that, if given two Board seats, he would work with Masimo to get back “the Joe Kiani multiple” in the stock price. |

“Masimo’s efforts to enter adjacent markets have … caused the Company to miss company-wide cash flow targets by 55% …” | Free cash flow reached $239 million in FY 2021 vs. the long-term target of $150-275 million established at the 2017 Investor Day. |

______________

(2) Masimo sought this discovery under a strict Court Protective Order that prohibits use or disclosure of information by both parties outside the litigation. Politan initially claimed that its confidentiality agreements with its investors prohibited their disclosure. Masimo suggested that Politan could simply redact the names of its investors. Politan later retreated and told the Court that it would not argue that its agreements prohibited disclosure, yet the court did not allow Masimo discovery. Masimo obtained no “commercially sensitive” information from Politan at any time.

“Masimo’s stock price has significantly underperformed any relevant set of peers over any relevant time period.” | Masimo has delivered Total Shareholder Return among the best in its industry and has outperformed key peers and relevant market indices over nearly all relevant time periods. Politan has cherry-picked a set of peers that include companies that are the targets of acquisitions, have very different scale and financial profiles, or are not even medical technology companies. All TSR information is as of the unaffected date May 1, 2023, the day before Politan filed its preliminary proxy materials and it became certain that Quentin Koffey would be a nominee. We believe the subsequent decline reflects the market’s concern about Mr. Koffey’s plans for the Company and the risks of his agenda with respect to Mr. Kiani. See Figure 2. |

“Masimo meaningfully underearns as it invests in new product launches into adjacent markets ...”

“Shortfalls cause Masimo to miss margin expansion targets by 54%, miss cash flow targets by 55% and ROIC to decline by 30%: Accelerating investments with little revenue and no profits have resulted in Masimo missing company-wide margin and cash flow targets. Most notably, ROIC has consistently declined despite a recurring revenue model that ought to result in expanding ROIC.” | The Company has delivered strong returns for shareholders through innovation and sustained improvement in operating performance that has driven consistent profitable, above-market growth. From 2017 through 2021 Masimo delivered profitability and earnings that significantly exceeded targets set at the 2017 Investor Day:

See Figure 3.

During the same period, the Company’s innovation-focused strategy and thoughtful capital allocation sustained ROIC at levels well above the medical device industry and even Masimo’s prior performance. The supposed “consistent” declines in ROIC that Politan purports to identify are in fact a mirage created by the gradual, contractual cessation of the royalties (totaling over $700 million, including the settlement payment) won by Masimo’s defense of its intellectual property. Properly adjusting for those royalties yields a clear picture of Masimo’s highly disciplined capital allocation and expanding ROIC. See Figure 4.

Free cash flow reached $239 million in FY 2021 vs. the long-term target of $150-275 million established at the 2017 Investor Day.

Our gross margins have declined due to the impact of COVID-related supply chain challenges, which are now starting to improve, as well as significant increases in labor rates in Mexico. Masimo has moved quickly to establish manufacturing in Malaysia, which has many advantages, including lower labor rates. |

“… merely recouping the decline from Sound United would mean a 60+% increase in Masimo’s valuation …” | Immediately prior to Politan announcing its nominees in its preliminary proxy filing on May 2, 2023 (the “unaffected date”), Masimo had already erased the discount that had opened following the acquisition of Sound United and resumed trading at a substantial valuation premium to the Medical Devices Index, with the stock trading at a premium of 2.6x AV / NTM EBITDA as of May 1, 2023. See Figure 5. |

“Masimo is accelerating investments into areas further and further afield from its core competencies: Masimo appears to be doing everything everywhere all at once. Across hospital automation, smart watches, adaptive acoustic earbuds, and baby monitors (just to name a few), Masimo is entering new markets against new competitors through new distribution channels.” | Masimo had envisioned most of these products in the early 1990s and had been working towards them for decades. In the 2000s, it introduced rainbow, Halo, and hospital automation. In the 2010s, it introduced its first consumer products, iSpO2 and MightySat. In the 2020s, Masimo is fulfilling more of its long term plans. The products that Mr. Koffey cite as “further and further afield from [Masimo’s] core competencies” rely on SET Pulse Oximetry or adaptive signal processing – the same technology Masimo used to revolutionize pulse oximetry with SET. Rather than stray from its core competencies, Masimo is leveraging its prior investments in existing technologies and expertise. This leverage is expanding the TAM for Masimo’s lifesaving and life-improving solutions by more than $150 billion. See Figure 6. |

“The result has been a frenetic proliferation of new product launches, but no indication that Masimo is even cognizant of the need to build a repeatable and successful market entry process.” | Not only is Masimo “cognizant of the need to build a repeatable and successful market entry process” in consumer health, the rationale for the Sound United acquisition was, after significant Management and Board deliberation, to do just that in the least dilutive, least disruptive and most effective way possible. On Masimo’s 1Q 2023 earnings call on May 9, 2023, Mr. Kiani said, “As one of our first consumer health product launches, Stork is creating a great template for how our teams can leverage our integrated global brand and marketing framework, which we will rapidly refine and replicate as we learn from the Stork rollout and launch more consumer health products.” |

“The market applies more than $5 billion of negative value for Masimo’s adjacent market efforts out of a concern that not only will Masimo fail, but also that Masimo’s Board will allow such failures to continue indefinitely.” | Masimo’s Board has set clear guardrails in the Company’s pursuit of its consumer health strategy, beginning with the reasonable and accretive purchase price for Sound United and the modest use of financial leverage. We have publicly explained our commitment to exit the business in three years from the date of the acquisition if our consumer health products do not gain traction in the market. We have limited our incremental spending on consumer product launches and are intensely focused on leveraging Sound United’s existing 20,000 points of distribution and 500 consumer sales and marketing professionals to drive consumer adoption. |

“In six of the last 12 years (including last year), Masimo has failed” say-on-pay. | Masimo’s shareholders voted in favor of say-on-pay in 5 of the last 6 years, 2017, 2018, 2019, 2020 and 2021, and against only in 2022. |

“Unusual side payments are even larger: The Board permits various side payments to Mr. Kiani. Masimo pays $17 million a year in royalties to Cercacor, a company where Mr. Kiani is CEO, Chairman and majority-owner.” | Masimo’s royalty payments to Cercacor relate to Cercacor’s ownership of intellectual property licensed to Masimo for use in rainbow®. These agreements date back to 1998, when, at the suggestion of the independent members of the Board, Cercacor was spun off pro rata to all Masimo shareholders ahead of a planned Masimo IPO. The agreement between the companies was disclosed during the Masimo’s 2007 IPO and has been disclosed in all of Masimo’s annual SEC filings since then. Mr. Kiani’s present majority ownership of Cercacor is due to his disproportionate participation in Cercacor’s subsequent capital raises. |

“Mr. Kiani’s employment agreement includes a special payment that is triggered by common governance changes such as appointing a Lead Independent Director or shareholders voting to change more than one-third of the Board.” | Mr. Kiani’s original employment agreement was executed in 1995, long before Masimo’s IPO. In 2015, the Board asked Mr. Kiani to agree to amend his employment agreement and forego some of its favorable terms, and in return offered Mr. Kiani other terms which were important to retaining Mr. Kiani. Mr. Kiani has recently waived certain rights under his current employment agreement, including permanently and irrevocably waiving his right to the special payment upon the appointment of a Lead Independent Director, because he believes Mr. Koffey poses a serious threat to Masimo’s future. |

“In 2015 shareholders sued the Board for granting Mr. Kiani three times the permitted number of options in Masimo’s compensation policy for four consecutive years.” | A shareholder plaintiff filed a derivative suit against Masimo in 2012. It settled in 2015.

The Board did not grant Mr. Kiani three times the permitted number of options. The shareholder plaintiff in 2012, and now Politan, fail to account for a 3-for-1 forward split of common stock on June 25, 2007, just before Masimo’s IPO. Prior to the IPO, Mr. Kiani was contractually entitled to receive 100,000 options (pre-split) annually. The 3-for-1 forward split resulted in Mr. Kiani being granted 300,000 options annually, and other Masimo employees also being granted 3 times the number of options they would have received before the split. |

“The Board entered a governance agreement requiring it to expand to seven directors. Not only did the Board not comply with the commitment, the directors approved the egregious 2015 employment agreement just a few months later.” | Masimo complied with the governance agreement in the 2015 settlement with the shareholder plaintiff, which provided that “[t]he Board will vote to increase the size of the Board to at least 7 directors”. As disclosed in Masimo’s public filings, two directors left the Board in the 12 months following the execution of the governance agreement. The Board searched for suitable independent candidates to replace the departing directors and to expand the Board. By 2018, the Board was comprised of seven members and by early 2019, the Board was comprised of eight members, six of whom were deemed independent under applicable listing rules. The governance agreement expired in May 2020. |

“This has included pushing a director off the Board who opposed Mr. Kiani’s compensation demands . . . .” | The director voluntarily declined to stand for reelection and was not pushed off the Board. Also, the changes to Mr. Kiani’s employment agreement were not initiated by Mr. Kiani but requested by the Board, resulting in a long negotiation with the independent Compensation Committee of the Board in which both sides were advised by nationally recognized counsel and compensation consultants. |

“[Mr. Cohen] testified under oath that he doesn’t see the point of corporate governance, stating, ‘Better governance doesn’t drive better stock price.’” | Mr. Cohen is a firm believer in the value of good governance, and his quote was taken out of context. Mr. Cohen was explaining during his 11-hour deposition by Politan why he believed Politan must have a plan that it was not disclosing to the Board or shareholders

Mr. Cohen: “I can’t believe, based on my knowledge, that you have an investor who’s going to take almost a billion-dollar stake and all they want is board seats to improve governance?”

* * * Politan’s attorney: “So I said, so you don’t believe better governance drives share price?

Mr. Cohen: “And I should say, better governance exclusively does not drive better share price.”

* * * Politan’s attorney: “So your concern was that Politan was out for more than better governance?”

Mr. Cohen: “I believed that there was another plan that was out there. And by the way, when I started to talk to investors, one investor, they told me that Politan was reaching out talking about cutting costs, getting rid of Sound United. So I had heard that they had other plans that they were voicing to investors and maybe analysts but never shared it with the board. Why is that?” |

“We asked the Board to commit to using a search firm to find director candidates (every current director was preselected by Mr. Kiani), to not include people with pre-existing relationships to the Board and to allow the newly constituted Board to carry out the search. Masimo flatly denied each of our requests with no explanation as to why.” | Masimo’s Board was using a national, reputable search firm to identify potential director candidates with a clear set of qualifications before Politan made its request. Further, the Board has repeatedly offered to work together with Politan to identify and add to the Board two mutually acceptable directors independent of both Masimo and Politan. Politan refused to work with Masimo, and actually demanded, with the threat of additional costly litigation, that the “Board not implement any expansion until after the 2023 annual meeting and that no additional directors would be added to the Board as part of an expansion without the approval of at least one director elected at the 2023 annual meeting.” The Board agreed to Politan’s demand not to implement any expansion until after the 2023 annual meeting and to allow shareholders to vote on the expansion. |

“While the Board ultimately did remove the bylaws, it has refused to commit to not restore them again after this annual meeting.” | While the Board continues to believe transparency is important to its shareholders, the Board does not intend to restore the bylaw amendments. |

About Masimo

Masimo (Nasdaq: MASI) is a global technology company that develops and produces a wide array of industry-leading monitoring technologies, including innovative measurements, sensors, patient monitors, and automation and connectivity solutions. In addition, Masimo Consumer Audio is home to eight legendary audio brands, including Bowers & Wilkins®, Denon®, Marantz®, and Polk Audio®. Our mission is to improve life, improve patient outcomes and reduce the cost of care. Masimo SET® Measure-through Motion and Low Perfusion™ pulse oximetry, introduced in 1995, has been shown in over 100 independent and objective studies to outperform other pulse oximetry technologies. Masimo SET® has also been shown to help clinicians reduce severe retinopathy of prematurity in neonates, improve CCHD screening in newborns, and, when used for continuous monitoring with Masimo Patient SafetyNet™ in post-surgical wards, reduce rapid response team activations, ICU transfers, and costs.

Contacts

Investor Contact: Eli Kammerman

(949) 297-7077

ekammerman@masimo.com

Media Contact: Evan Lamb

(949) 396-3376

elamb@masimo.com

Read full story here

Editor Details

-

Company:

- Businesswire