Pet Insurance Market Projected Surge To USD 19.15 Billion By 2033, With A Steady 11.9% CAGR

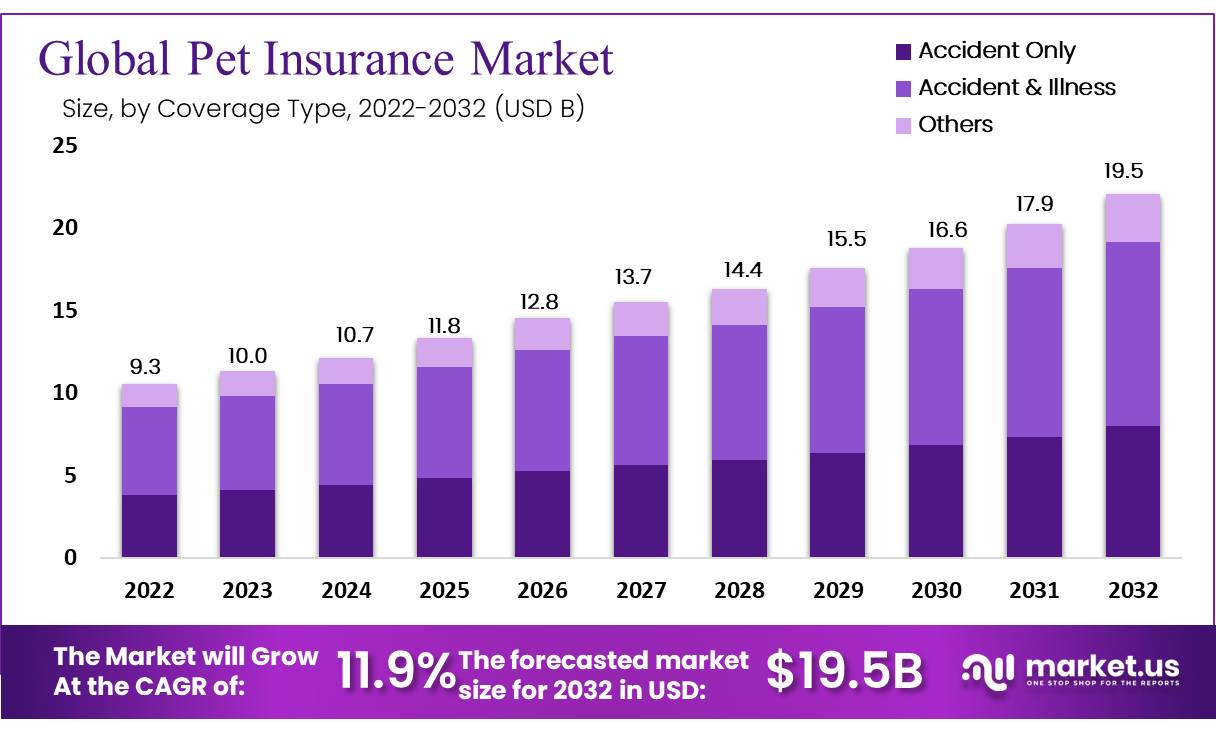

According to Market.us, the global pet insurance market is projected to reach approximately USD 19.15 billion by 2032, up from USD 9.3 billion in 2022. This represents a compound annual growth rate (CAGR) of 11.9% over the forecast period from 2022 to 2032.

The Pet Insurance Market is undergoing significant transformations, influenced heavily by its interconnectedness with various end-use industries. These industries are pivotal in shaping the Pet Insurance Market’s dynamics, as they drive demand and set stringent quality standards. The alignment between the market offerings and the industries’ evolving needs ensures a consistent demand, fostering a scenario ripe for sustained growth in the Pet Insurance sector. This interdependence necessitates that market players remain agile, innovative, and responsive to the shifting requirements and emerging trends within these pivotal sectors.

Regulatory frameworks set by governments worldwide are integral to the Pet Insurance Market’s structure, influencing its operational, environmental, and compliance standards. These regulations ensure the market’s adherence to safety, quality, and sustainability norms, which are increasingly becoming stringent. The adherence to these standards in the Pet Insurance Market is not just about legal compliance but also about building trust with consumers and maintaining a competitive edge. The market’s resilience is thus tied to its ability to navigate the complex regulatory landscape, adapt to new laws, and uphold the highest standards of operational excellence.

The Pet Insurance Market’s dynamics are further shaped by the intricate import-export mechanisms and the flow of investments. Changes in trade policies, import-export regulations, and international tariffs directly influence the Pet Insurance Market’s stability and growth trajectories. Investment from both governmental and private sectors plays a critical role, underpinning innovation and technological advancements in the Pet Insurance arena. These investments, along with strategic initiatives like mergers, acquisitions, and partnerships, are pivotal in driving the market forward, enabling scalability, and enhancing its global outreach.

Get sample: https://market.us/report/pet-insurance-market/request-sample/

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 9.3 Billion |

| Forecast Revenue 2033 | USD 19.15 Billion |

| CAGR (2024 to 2033) | 11.9% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Key Takeaways

In this market research, Market.us uncovered key insights that offer actionable takeaways and provide a clear direction for future market strategies. Pet Insurance market findings reveal critical trends and developments that shape the market landscape. These insights equip businesses with valuable information to make informed decisions and stay ahead of the competition. By understanding consumer preferences, market dynamics, and emerging opportunities, companies can optimize their product offerings, refine their marketing strategies, and capitalize on growth prospects. Pet Insurance research highlights the importance of staying agile and adaptable in response to evolving market conditions. With these key takeaways, businesses can confidently navigate the market landscape, mitigate risks, and drive sustainable growth in the long term.

Key Takeaways Covered In Pet Insurance Market Research Report Are:

- By 2032, the pet insurance market is projected to achieve a valuation of USD 27.8 billion.

- An annual growth rate of 11.9% is expected for the market from 2023 to 2032.

- In 2022, the accident & illness segment held the largest share in the pet insurance market.

- The cat segment is predicted to lead the market in terms of animal type over the forecast period.

- The direct sale channel was the predominant sales channel in the market in 2022.

- Europe was the leading region in the pet insurance market in 2022, comprising 30% of the market share.

- North America is forecast to secure the position of the second-largest market in terms of revenue during the forecast period.

- The highest compound annual growth rate is anticipated to be seen in the Asia Pacific region throughout the forecast period.

Get quick access to our premium research report: https://market.us/purchase-report/?report_id=32245

Market Segmentation Analysis

In market research, it’s essential to identify and understand various market segments to tailor strategies effectively. By delineating the key market segments within the Pet Insurance market, businesses can refine their approach to cater to specific customer groups. This segmentation allows for more targeted marketing efforts, product development, and customer relationship management. Through thorough analysis, industries can identify common characteristics, needs, preferences, and behaviors within each segment. Pet Insurance insights enable companies to craft tailored messaging, promotions, and offerings that resonate with the unique needs of each segment. Moreover, understanding Pet Insurance market segments facilitates resource allocation, helping businesses allocate their resources efficiently and maximize their return on investment. Overall, identifying and targeting key market segments is crucial for businesses seeking to effectively engage with their target audience and achieve sustainable growth.

Based on Coverage Type

- Accident Only

- Accident & Illness

- Others

Based on Animal Type

- Dogs

- Cats

- Others

Based on Sales Channel

- Broker

- Direct

- Agency

- Bancassurance

Based on Provider

- Public

- Private

Request a sample copy of the report: https://market.us/report/pet-insurance-market/request-sample/

Market Dynamics

When researching the Pet Insurance industry, it’s crucial to understand and leverage factors that drive growth. These may include technological advancements, increasing consumer demand, and supportive government policies. By recognizing and capitalizing on these forces, Pet Insurance industry can position themselves strategically to capitalize on growth opportunities. However, it’s also important to address market restraints such as regulatory challenges, economic downturns, and shifting consumer preferences. By identifying these obstacles early on, businesses can develop strategies to mitigate their impact and navigate through challenges effectively.

Additionally, exploring untapped Pet Insurance market opportunities and emerging trends is essential. This involves identifying new market segments or niche markets and developing targeted strategies to capture these opportunities. Staying informed about Pet Insurance market trends, including shifts in consumer behavior, technological innovations, and the competitive landscape, is crucial for maintaining a competitive edge. Overall, comprehensive market research involves analyzing internal and external factors to make informed decisions and drive sustainable growth within the Pet Insurance industry.

Regional Analysis

The regional analysis of the Pet Insurance market provides valuable insights into its performance across various geographical areas, offering a comprehensive understanding of the opportunities and challenges present in each region. By examining factors such as economic conditions, regulatory frameworks, consumer preferences, and competitive landscapes, researchers can identify key trends and dynamics shaping Pet Insurance market dynamics at the regional level. This analysis enables stakeholders to tailor their strategies and investments to capitalize on specific market nuances and maximize growth potential. Moreover, understanding regional variations allows companies to mitigate risks associated with Pet Insurance market fluctuations and adapt their approaches to effectively target diverse customer segments. Overall, a robust regional analysis serves as a vital tool for informed decision-making and successful market penetration strategies.

Key regions Covered In this report are

- North America(US, Canada)

- Europe (Germany, France, The UK, Spain, Italy, Russia, Netherland, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA

To tailor this report to your needs, let’s delve deeper into the specifics of the report: https://market.us/report/pet-insurance-market/#inquiry

Competitive Analysis

In assessing the competitive landscape of the Pet Insurance market, it is essential to analyze key players’ strengths, weaknesses, and strategies. Leading companies in the healthcare sector typically have robust distribution networks, strong brand recognition, and diversified product portfolios, which are their primary strengths. However, they may also face challenges such as fluctuating market demand, regulatory constraints, and competitive pricing pressures. Strategies employed by Pet Insurance industry players often include product innovation, strategic partnerships, mergers and acquisitions, and market expansion initiatives. By continuously leveraging their strengths and addressing weaknesses, these companies strive to maintain or enhance their market position while adapting to evolving industry dynamics. A comprehensive understanding of the competitive landscape enables stakeholders to make informed decisions and develop effective strategies to capitalize on Pet Insurance market opportunities.

Leading Pet Insurance Market Players Are:

- Trupanion

- Nationwide Mutual Insurance Company

- Healthy Paws Pet Insurance LLC

- Embrace Pet Insurance Agency LLC

- Anicom Holdings

- Figo Pet Insurance LLC.

- Agria Pet Insurance Ltd.

- 24 Pet Watch

- Pets Best Insurance Services LLC

- ASPCA

- Pet Plan Insurance

- MetLife Services and Solutions LLC

- Petfirst Healthcare LLC

- Ipet Insurance Co Ltd.

- Hartville Group

- ASPCA Pet Insurance

- Animals Friends Insurance Services Limited

- Progressive Casualty Insurance Company

- Other Key Players

Recent Developments

Recent developments in the Pet Insurance market, including mergers, acquisitions, and product launches, are shaping the industry landscape. These events reflect strategic maneuvers by companies to gain competitive advantage and expand their market presence. Mergers and acquisitions often lead to market consolidation and portfolio diversification, while new product launches drive innovation and address evolving consumer demands. Staying informed about Pet Insurance developments is crucial for understanding market dynamics and identifying opportunities for growth and investment.

This ‘Pet Insurance Market’ report is your key to:

- Making informed investment decisions: Identify lucrative opportunities in Pet Insurance market and mitigate risks based on data-driven insights.

- Developing effective business strategies: Gain a competitive edge by tailoring your strategies to the specific needs of the Pet Insurance market.

- Optimizing your marketing efforts: Identify and target the most profitable customer segments with laser focus.

- Staying ahead of the curve: Anticipate Pet Insurance future trends and adapt your business strategies accordingly.

Benefits Of Pet Insurance Market Reports

- Insightful Analysis: Pet Insurance Market reports offer in-depth analysis of industry trends, providing valuable insights into market dynamics, consumer behavior, and emerging opportunities.

- Strategic Planning: Businesses can use Pet Insurance market reports to develop informed strategies, including product development, marketing campaigns, and market expansion plans, based on comprehensive data and analysis.

- Risk Mitigation: By understanding market trends and potential challenges, companies can proactively mitigate risks and adapt their business strategies to changing market conditions.

- Competitive Intelligence: Pet Insurance Market reports often include competitive analysis, helping businesses understand their competitors’ strengths, weaknesses, and market positioning to gain a competitive edge.

- Investment Decision Support: Investors can use Pet Insurance market reports to evaluate investment opportunities, assess market potential, and make informed decisions based on market projections and growth forecasts.

- Market Sizing and Segmentation: Pet Insurance Market reports provide accurate market sizing and segmentation data, enabling businesses to identify target markets and tailor their products or services to meet specific customer needs.

- Regulatory Compliance: Pet Insurance Market reports often include information on regulatory frameworks and industry standards, helping businesses stay compliant with relevant regulations and standards.

- Benchmarking Performance: Companies can benchmark their performance against industry standards and key performance indicators (KPIs) outlined in Pet Insurance market reports, facilitating performance improvement and goal setting.

- Enhanced Marketing Effectiveness: Marketing teams can leverage Pet Insurance market reports to develop more targeted and effective marketing campaigns by understanding consumer preferences, trends, and purchasing behavior.

- Customized Solutions: Market.us (market research firm) offer customized reports tailored to the specific needs of clients, providing actionable recommendations for their unique business requirements.

Don’t miss out on this valuable resource! Order your copy of the report today and unlock the full potential of this thriving industry!: https://market.us/purchase-report/?report_id=32245

Contact Details

Market.us (Powered By Prudour Pvt. Ltd.)

Contact No: +1 7186184351.

Email: inquiry@market.us

Blog: https://medicalmarketreport.com/

View More Trending Reports

Ophthalmic Devices Market Will Reach USD 76 Billion By 2033 And Hit Around 4.8% CAGR

Tissue Engineering Market Predicted USD 35.2 Billion By 2032, An Approximate 11.4% CAGR Growth

Biologics Market to Approach USD 894 Billion by 2032

Digital Health Market Set to Hit USD 1190.4 Billion by 2032

Surgical Procedures Volume Market

Intracranial Hemorrhage Diagnosis and Treatment Market

Editor Details

-

Company:

- Wired Release

- Website: