Biofungicides Market Size, To Witness Promising Growth Rate 15.8% by 2033

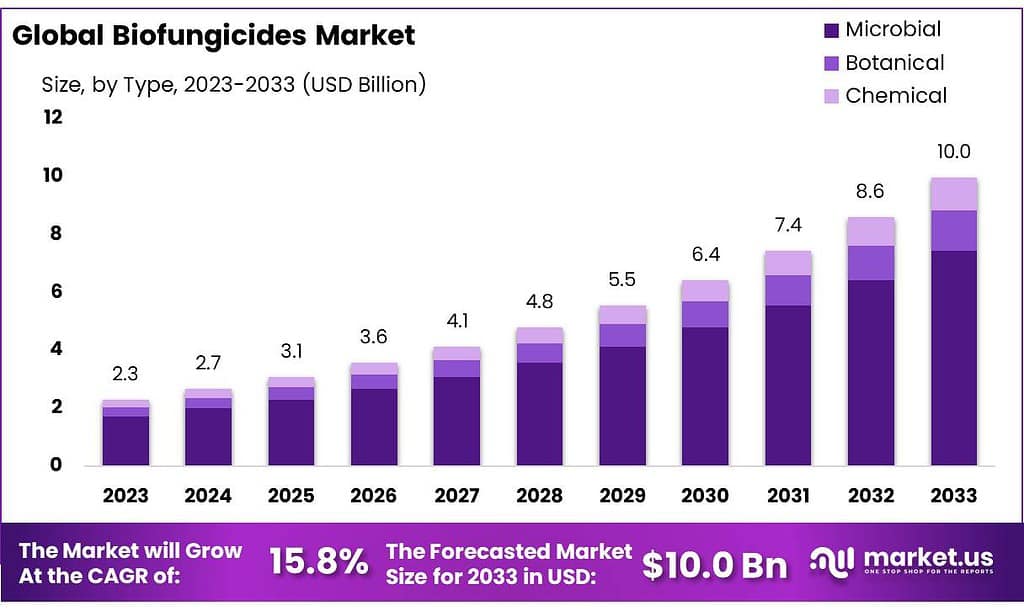

Global Biofungicides Market size is expected to be worth around USD 10.0 billion by 2033, from USD 2.3 billion in 2023, growing at a CAGR of 15.8% during the forecast period from 2023 to 2033.

Biofungicides are natural substances or living microorganisms utilized in agriculture to safeguard plants from harmful fungi, thereby preventing crop damage. They act as superheroes for plants, employing the power of nature, such as beneficial bacteria or fungi, to combat plant-damaging fungi. Farmers opt for biofungicides as an eco-friendly and sustainable alternative to chemicals, promoting harmony in the plant world while minimizing environmental impact.

Key Takeaways

- Market Growth: The biofungicides market is projected to reach USD 10.0 billion by 2033, experiencing a robust growth rate of 15.8% CAGR from 2023.

- Dominant Type: Microbial biofungicides held a significant market share of 74.6% in 2023, demonstrating their effectiveness in protecting plants.

- Preferred Formulation: Powder biofungicides led the market with a 48.6% share in 2023, valued for their convenience in storage and application.

- Primary Application: Soil treatment biofungicides commanded a market share of 45.7% in 2023, emphasizing their role in promoting soil health for optimal crop growth.

- Top Crop Segment: Fruits & vegetable biofungicides dominated the market with a 42.1% share in 2023, ensuring high-quality produce.

- Regional Analysis: North America emerged as the leading region with a market share of 42.5% in 2023, driven by a focus on sustainability and innovation.

To understand how our report can make a difference to your business strategy, Inquire about a brochure at: https://market.us/report/biofungicides-market/request-sample/

Factors affecting the growth of the Biofungicides Market

- Increasing Demand for Sustainable Agriculture: Growing awareness of environmental sustainability drives demand for biofungicides as eco-friendly alternatives to chemical pesticides.

- Regulatory Support: Favorable regulations promoting the use of biofungicides encourage market growth by incentivizing their adoption among farmers.

- Rising Concerns about Chemical Residues: Consumer preferences for pesticide-free produce stimulate demand for biofungicides, which offer residue-free crop protection.

- Effectiveness and Performance: Advances in biofungicide formulations and technologies enhance their efficacy, boosting confidence in their effectiveness among farmers.

- Expansion of Organic Farming: The expanding organic farming sector creates a conducive environment for biofungicide adoption, aligning with organic certification requirements.

- Integrated Pest Management (IPM) Practices: Biofungicides complement IPM strategies by offering sustainable pest control solutions, contributing to market growth.

- Technological Innovations: Ongoing research and development efforts result in the development of novel biofungicides with improved performance and broader spectrum activity, driving market expansion.

Market Leading Segmentation

By Type: In the thriving Biofungicides Market of 2023, microbial biofungicides dominated, comprising a substantial 74.6% share. These living microorganisms, such as beneficial bacteria and fungi, serve as natural defenders against harmful fungi, ensuring plant health and eco-friendly disease management. Key players include Trichoderma, Streptomyces, Bacillus, and Pseudomonas, which combat pathogens effectively, alongside botanical and chemical alternatives.

By Form: Powder bio fungicides emerged as the leading choice in the bustling Biofungicides Market of 2023, commanding a notable 48.6% share. Known for their convenience in storage and application, powdered bio fungicides offer farmers ease of use and versatility in safeguarding their crops. Liquid and granular forms also play significant roles, offering unique advantages in application convenience and effectiveness.

By Application: Soil Treatment biofungicides took center stage in the thriving Biofungicides Market of 2023, capturing an impressive 45.7% share. These defenders fortify soil against harmful fungi, establishing a strong foundation for plant health. Seed Treatment and Foliar applications complement soil treatments, providing comprehensive protection during different stages of plant growth.

By Crop Type: Fruits & Vegetables led the Biofungicides Market of 2023, commanding a dominant 42.1% share. These bio fungicides shield crops like tomatoes and apples from harmful fungi, ensuring the quality and health of produce. Cereals & Grains and Oilseeds & Pulses segments also benefit from specialized bio fungicides tailored to their specific disease challenges, contributing to healthy harvests.

Market Key Segments

By Type

- Microbial

- Trichoderma

- Streptomyces

- Bacillus

- Pseudomonas

- Botanical

- Chemical

- Others

By Form

- Powder

- Liquid

- Granules

By Application

- Soil Treatment

- Seed Treatment

- Foliar

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Market Key Players

- BASF SE

- Bayer AG

- Syngenta AG

- FMC Corporation

- Nufarm

- Novozymes

- Isagro S.P.A

- T. Stanes & Company Limited

- UPL Ltd

- BioWorks

- The Stockton Group

- Bioworks Inc.

- Corteva Agriscience

- Koppert Biological Systems Inc.

- Marrone Bio Innovations Inc.

- Seipasa SA

Immediate Delivery Available | Buy This Premium Research Report@ https://market.us/purchase-report/?report_id=116150

Regional Analysis

North America leads the Biofungicides Market, commanding a significant 42.5% share in 2023. Spearheaded by the United States, the region prioritizes energy security and reliability, driving the widespread adoption of biofungicides. Aging grid infrastructure and extreme weather events underscore the need for sustainable solutions.

Industries and communities in North America increasingly recognize the importance of energy independence and sustainability. This awareness drives investments in advanced energy solutions, with biofungicides prominently featured. Stakeholders understand the benefits of biofungicides, including enhanced disease control and environmental friendliness, motivating investment in these agricultural solutions.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Drivers:

- Growing Health Consciousness: Rising consumer awareness of the health benefits of fruits and vegetables drives demand, supported by knowledge of their role in preventing chronic diseases and improving overall well-being.

- COVID-19 Pandemic Impact: The pandemic highlights the importance of a healthy diet for immunity, boosting interest in foods supporting health and wellness, particularly those perceived as safe and nutritious.

- Environmental Awareness: Consumers prioritize environmentally friendly practices, increasing demand for sustainably grown produce and products with lower environmental footprints.

Restraints:

- Supply Chain Disruptions: Vulnerability to disruptions due to natural events, logistical challenges, and regulatory issues impacts availability and pricing of fresh produce.

- Logistical Challenges: Transportation delays, labor shortages, and trade restrictions hinder the smooth functioning of the supply chain, affecting quality and increasing costs.

- Globalization Risks: Reliance on global supply chains amplifies vulnerability to disruptions, necessitating investments in technology and infrastructure for resilience.

Opportunities:

- Organic and Sustainable Produce: Growing consumer demand for organic and sustainable products presents opportunities for market players to invest in organic farming techniques and capitalize on the trend.

- E-commerce Platforms: The rise of online shopping allows growers to reach health-conscious consumers seeking high-quality produce, leveraging technology and e-commerce infrastructure.

- Urban Farming and CSA: Local growers can connect directly with consumers through farmers’ markets and CSA programs, meeting demand for locally sourced, sustainably grown fruits and vegetables.

Trends:

- Plant-Based Diets: Increasing adoption of plant-based diets driven by health, environmental, and ethical concerns fuels demand for fruits and vegetables as primary sources of nutrition.

- Sustainability: Consumers prioritize environmentally friendly practices, favoring products with lower environmental footprints and driving demand for sustainably grown produce.

- Innovation in Meat Alternatives: Plant-based meat and dairy alternatives offer consumers the taste and texture of animal-based products without environmental concerns, driving demand for innovative fruit and vegetable-based alternatives.

Conclusion

In conclusion, the biofungicides market is poised for significant growth driven by various factors such as increasing health consciousness among consumers, growing demand for organic and sustainable produce, and the rise of plant-based diets. Despite facing challenges like supply chain disruptions and logistical issues, opportunities abound, particularly in meeting the demand for eco-friendly agricultural solutions. With the ongoing focus on sustainability and innovation, the biofungicides market is expected to thrive, offering a promising outlook for stakeholders across the industry.

Get in Touch with Us:

Global Business Development Team – Market.us

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300,

New York City, NY 10170, United States

Tel: +1 718 618 4351

Email: inquiry@market.us

Explore More Market.us Research Reports

Editor Details

-

Company:

- Wired Release

- Website: