Wellness and Activity-based Health Insurance Market: A Comprehensive Study of the Industry Whereabouts

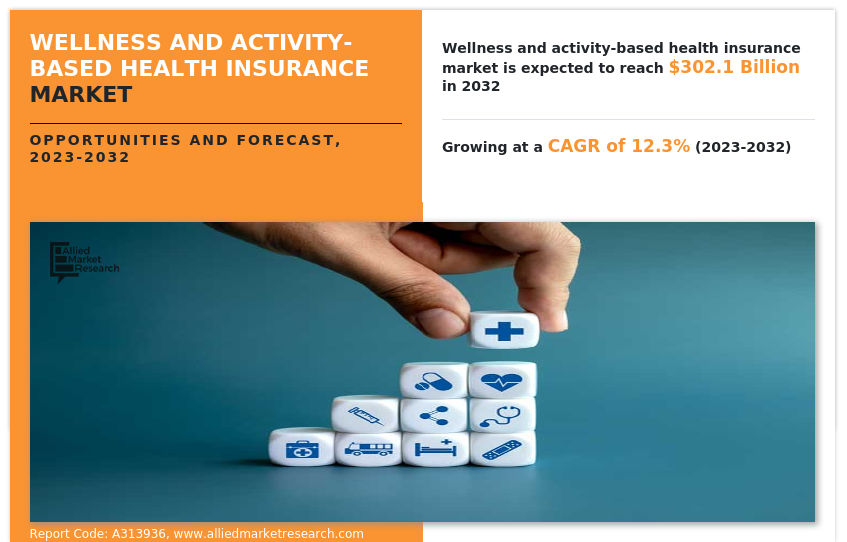

Allied Market Research published a report on the global wellness and activity-based health insurance market that is expected to reach $302.1 billion in 2032. The industry size which was estimated at $97 billion in 2022 is expected to witness an impressive growth of more than three times, at a CAGR of 12.3%. The forecast period is considered between 2023 and 2032. Additionally, the report includes an insightful, detailed study of the market dynamics, contemporary trends, and competitive landscape, providing a detailed overview of the industry.

Wellness and Activity-based Health Insurance Market

Wellness and Activity-based Health Insurance Market

Request Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/A313936

Key highlights

- The report includes a comprehensive analysis of the market forecast along with the contemporary trends and future estimations to explain the upcoming investment pockets. Information about key drivers, restraints, & opportunities and their impact analysis is provided in the report.

- Through an impeccable research methodology consisting of analytical tools like Porter’s five forces and expert interventions, the report also provides high-quality data and refined insights into the industry’s whereabouts.

- Furthermore, quantitative analysis helps in determining the market potential during the forecast period, enabling stakeholders to understand how to execute their future growth objectives.

Factors influencing the market

The wellness and activity-based health insurance market is influenced by several key factors, including advancements in wearable technology, the rise of preventative healthcare initiatives, and shifting consumer preferences toward personalized wellness solutions. Additionally, regulatory changes, such as incentivizing healthy behaviors and promoting transparency in healthcare pricing, play a significant role in shaping this market. Furthermore, the growing emphasis on value-based care models and the integration of data analytics to assess individual health risks contribute to the evolution of activity-based health insurance offerings. Overall, these factors converge to drive innovation and competitiveness within the activity-based health insurance sector.

The group plans segment to maintain its leadership status throughout the forecast period

Based on the type, the individual plans segment held the highest market share in 2022, accounting for nearly three-fifths of the global wellness and activity-based health insurance market revenue, owing to an increase in the adoption of innovative features and riders to enhance policyholder benefits, such as income guarantees, and accelerated death benefits helps to opt for indexed wellness and activity-based health insurance policies in the global market. However, the group plans segment is projected to manifest the highest CAGR of 13.7% from 2023 to 2032, owing to technological advancement and a rise in awareness among the people, which is projected to attract many new consumers. These factors are expected to boost the global market.

Inquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A313936

The mental health and well-being program segment to maintain its leadership status throughout the forecast period

Based on the program, the fitness program segment held the highest market share in 2022, accounting for more than two-thirds of the global wellness and activity-based health insurance market revenue. This is attributed to an expanding consumer base seeking comprehensive life insurance solutions with tailored features. However, the mental health and well-being program segment is projected to manifest the highest CAGR of 13.5% from 2023 to 2032, owing to the increasing convergence of financial services and the rising demand for comprehensive financial solutions.

The healthcare providers segment to maintain its leadership status throughout the forecast period

Based on the service provider, the insurance companies segment held the highest market share in 2022, accounting for nearly half of the global wellness and activity-based health insurance market revenue. This is attributed to the increasing demand for health insurance globally, major companies are expanding their product portfolios in different countries to strengthen their presence for these products and solutions in the market. However, the healthcare provider segment is projected to manifest the highest CAGR of 14.8% from 2023 to 2032, owing to the increasing convergence of financial services and the rising demand for comprehensive financial solutions.

Asia-Pacific to maintain its dominance by 2032

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for more than one-third of the global wellness and activity-based health insurance market revenue. The major factors that drive the growth of the market in this region include the presence of key players and the rise in the purchase of insurance. However, the Asia-Pacific region is expected to witness the fastest CAGR of 16.2% from 2023 to 2032 and is likely to dominate the market during the forecast period, owing to the surge in adoption of mobile telematics technology by insurance companies among the developing nations such as China and India.

Segmental orientation

Type

- Individual plans

- Group plans

- Program

- Fitness programs

- Mental health and well-being programs

Service provider

- Insurance companies

- Healthcare providers

- others

Regional dynamics

Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market in 2022 and is anticipated to retain its dominance during the forecast period.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/A313936

Contemporary trends in the industry, shaping the landscape

Contemporary trends in the market reflect a shift toward personalized wellness solutions and incentivizing healthy behaviors. This includes the integration of wearable devices and mobile apps to track physical activity, sleep patterns, and nutrition. Insurers are increasingly offering rewards and discounts to policyholders who meet certain health goals or participate in wellness programs. Furthermore, there is a growing emphasis on preventive care and holistic health management, with insurers focusing on proactive measures to improve overall well-being and reduce healthcare costs eventually. These trends highlight the industry’s commitment to promoting healthy lifestyles and empowering individuals to take control of their health.

Leading companies

Allied Market Research enlists the names and provides an exhaustive study of the industry leaders, documents their product portfolio, and investigates their overall performance. The key players in the wellness and activity-based health insurance market include:

- Cigna Corporation

- Humana Inc.

- Blue Cross Blue Shield Association

- Oscar Health

- Welltok, Inc.

- Anthem, Inc.

- Aetna Inc

- Kaiser Permanente

- United Health Group

These players often adopt various strategic moves like mergers, collaborations, partnerships, and acquisitions to stay ahead in the competitive landscape.

Why choose Allied Market Research?

- Exclusive product offerings

- Future market opportunities

- Latest technological advancements

- Quality assurance

- Value chain analysis

- Post-sales support

- Continuous report update

Allied Market Research’s wellness and activity-based health insurance industry report offers invaluable insights for stakeholders seeking to navigate the evolving landscape, providing comprehensive analysis to inform strategic decisions and drive innovation in the market.

𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Editor Details

-

Company:

- The Wire Times