Breast Cancer Diagnostics Market Forecast: Understanding the CAGR of 8.10% from 2025 to 2035

Breast Cancer Diagnostics Market Industry Report 2025-2035

The Global Breast Cancer Diagnostics Market is poised for substantial growth over the next decade, driven by technological advancements, increasing incidence rates, and growing emphasis on early detection. The Vantage Market Research report analyzes the market landscape from 2025 to 2035, providing stakeholders with critical insights into market dynamics, segmentation, competitive landscape, and emerging opportunities.

Breast cancer remains one of the most common cancers worldwide, with approximately 316,950 women projected to be diagnosed with invasive breast cancer in 2025 alone. The evolving diagnostic technologies landscape is transforming breast cancer detection, management, and treatment approaches, creating significant market opportunities across the value chain.

Key Takeaways from the Breast Cancer Diagnostics Market Report

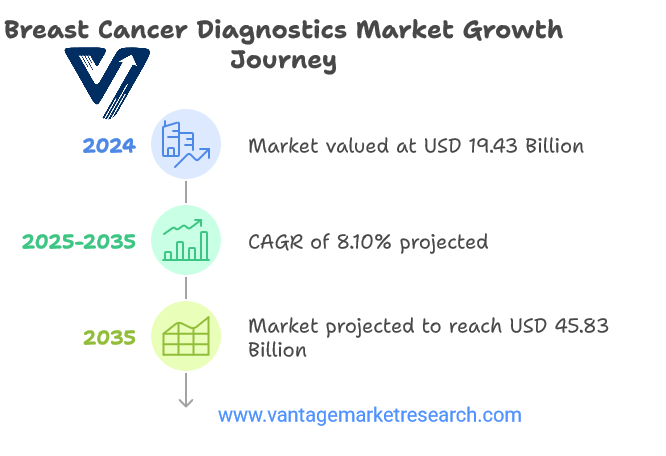

- Market Growth Trajectory: According to analysts at Vantage Market Research, the global breast cancer diagnostics market is projected to grow from approximately USD 19.43 billion in 2024 to USD 45.83 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.10%.

- Technological Revolution: Artificial intelligence (AI), liquid biopsy technologies, and genomic testing are revolutionizing breast cancer diagnostics, enabling earlier detection, improved accuracy, and personalized treatment approaches.

- Regional Leadership: North America dominates the market with approximately 45.8% market share, while Asia Pacific is anticipated to exhibit the fastest growth rate during the forecast period.

- Segment Dominance: The imaging segment represents the largest market share (52.74% as of 2022), while genomic testing is expected to witness the highest growth rate due to the increasing adoption of precision medicine approaches.

- Competitive Landscape: The market features established players and innovative entrants developing cutting-edge diagnostic technologies. Key industry participants include Hologic, Inc., Siemens Healthineers AG, GE Healthcare, BD (Becton, Dickinson and Company), Philips Healthcare, Thermo Fisher Scientific, and Roche Diagnostics, among others.

Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.vantagemarketresearch.com/breast-cancer-diagnostics-market-2523/request-sample

Market Dynamics

Growth Drivers: Rising Incidence and Prevalence Rates

The increasing global incidence of breast cancer is a primary driver for market growth. According to the National Cancer Institute, approximately 310,720 new cases of breast cancer were projected for 2024, along with 42,250 deaths. The alarming 1.4% annual increase in cases among women under 50 since the mid-2000s further emphasizes the need for advanced diagnostic capabilities.

Technological Advancements in Diagnostic Modalities

Continuous innovations in breast cancer diagnostic technologies are significantly enhancing detection capabilities:

- Advanced Imaging Technologies: The evolution from 2D mammography to digital breast tomosynthesis (3D mammography) has improved detection rates while reducing false positives.

- Artificial Intelligence Integration: AI algorithms have demonstrated up to 29% higher cancer detection rates compared to traditional screening methods.

- Molecular Diagnostics: Advancements in genomic and proteomic technologies enable more precise characterization of breast cancers, leading to better treatment decisions.

Growing Awareness and Screening Programs

Increasing awareness about the importance of early breast cancer detection has led to higher participation in screening programs globally. Government initiatives such as the UK National Health Service's expansion of free mammogram services have improved accessibility to diagnostic services.

Expanding Insurance Coverage

Improved insurance coverage for cancer screenings has made diagnostic services more affordable for many patients, driving market growth. The implementation of patient protection laws in various countries has further enhanced coverage for preventive services, including mammography and other breast cancer screening modalities.

Rising Healthcare Expenditure

Increasing healthcare expenditure, particularly in emerging economies, is expanding access to advanced diagnostic technologies. Countries like China, India, and Brazil are showing accelerated growth in the adoption of breast cancer diagnostic services due to enhanced government-backed healthcare initiatives and improved spending capacities.

Market Restraints & Challenges: High Costs of Advanced Diagnostic Technologies

The significant costs associated with advanced diagnostic technologies such as digital breast tomosynthesis, molecular diagnostic tests, and AI-powered systems can limit adoption, particularly in low-resource settings. The cost of a single genomic test can range from several hundred to several thousand dollars, making them inaccessible to many patients without adequate insurance coverage.

Regulatory Hurdles

Stringent regulatory requirements for diagnostic devices can delay market entry and product approvals. The lengthy approval processes for new diagnostic technologies can impede innovation and limit patient access to cutting-edge solutions.

Reimbursement Challenges

Inadequate or inconsistent reimbursement policies for newer diagnostic technologies can discourage healthcare providers from investing in advanced systems. Variations in coverage across different regions and insurance plans create disparities in access to quality diagnostic services.

Shortage of Skilled Professionals

A significant shortage of trained radiologists, pathologists, and other specialists required for accurate interpretation of diagnostic results poses challenges to market growth. The U.S. breast cancer screening and diagnostic market faces challenges due to imaging expertise shortages, leading to underutilization of available technologies.

Technical Limitations in Existing Technologies

Despite advancements, certain diagnostic modalities still face technical limitations such as false positives, false negatives, and challenges in detecting cancer in dense breast tissue, which can affect diagnostic accuracy and patient outcomes.

Take Action Now: Secure Your Position in the Global Breast Cancer Diagnostics Industry Today – Purchase Now.

Growth Opportunities & Emerging Trends: Integration of Artificial Intelligence

The incorporation of AI and machine learning technologies in breast cancer diagnostics represents a significant growth opportunity. AI-powered systems can improve diagnostic accuracy, reduce interpretation times, and help address the radiologist shortage. Studies have shown that AI-supported screening has led to 29% more cancer detections compared to traditional methods.

Liquid Biopsy Advancements

The liquid biopsy market for breast cancer is projected to reach USD 2.89 billion by 2034, growing at a CAGR of 8.2%. These minimally invasive tests analyze circulating tumor cells and cell-free DNA in blood samples, enabling real-time monitoring and comprehensive genetic profiling of tumors.

Growth in Genomic and Personalized Testing

The shift toward precision medicine is driving demand for genomic tests that provide personalized insights for treatment decisions. Tests like Exact Sciences' Oncotype DX are revolutionizing treatment approaches by identifying patients who may or may not benefit from chemotherapy based on their unique tumor biology.

Multi-Modality Imaging Integration

The trend toward integrating multiple imaging modalities such as mammography, ultrasound, and MRI into unified platforms is creating opportunities for comprehensive diagnostic solutions. These integrated systems offer improved detection capabilities across diverse patient populations.

Telemedicine and Remote Diagnostic Services

The expansion of telemedicine networks is improving access to diagnostic services, particularly in rural and underserved areas. Digital pathology solutions enable the remote interpretation of results, increasing diagnostic capacity and reducing turnaround times.

Regional Breakdown: North America

North America holds the largest market share (approximately 45.8% as of 2022) due to the following:

- High incidence rates of breast cancer

- Advanced healthcare infrastructure

- Favorable reimbursement policies

- Presence of major market players

- Strong governmental support for screening programs

Europe

Europe represents the second-largest market for breast cancer diagnostics, driven by:

- Well-established healthcare systems

- Increasing government initiatives for cancer screening

- Growing adoption of advanced diagnostic technologies

- Rising awareness about early detection

Countries like Germany, France, and the UK lead the European market due to their substantial healthcare expenditure and robust screening programs.

Asia Pacific

The Asia Pacific region is expected to witness the fastest growth during the forecast period, attributed to:

- Increasing healthcare expenditure

- Rising breast cancer incidence rates

- Growing awareness about early detection

- Improving access to advanced diagnostic technologies

- Government initiatives to enhance cancer care

Countries like China, India, and Japan are emerging as key markets due to their large population bases and improving healthcare infrastructure.

Latin America

The Latin American market is gradually expanding due to:

- Increasing investments in healthcare infrastructure

- Rising awareness about breast cancer screening

- Growing medical tourism

- Government initiatives to improve cancer care

Brazil and Mexico represent the largest markets in this region, with significant growth potential.

Middle East & Africa

While currently a smaller market, the Middle East & Africa region is expected to show steady growth due to:

- Increasing healthcare investments, particularly in GCC countries

- Rising awareness about breast cancer

- Improving access to diagnostic services

- International collaborations to enhance cancer care

For the Breast Cancer Diagnostics Market Research Report and updates, view the full report now!

Global Breast Cancer Diagnostics Market Report Segmentation

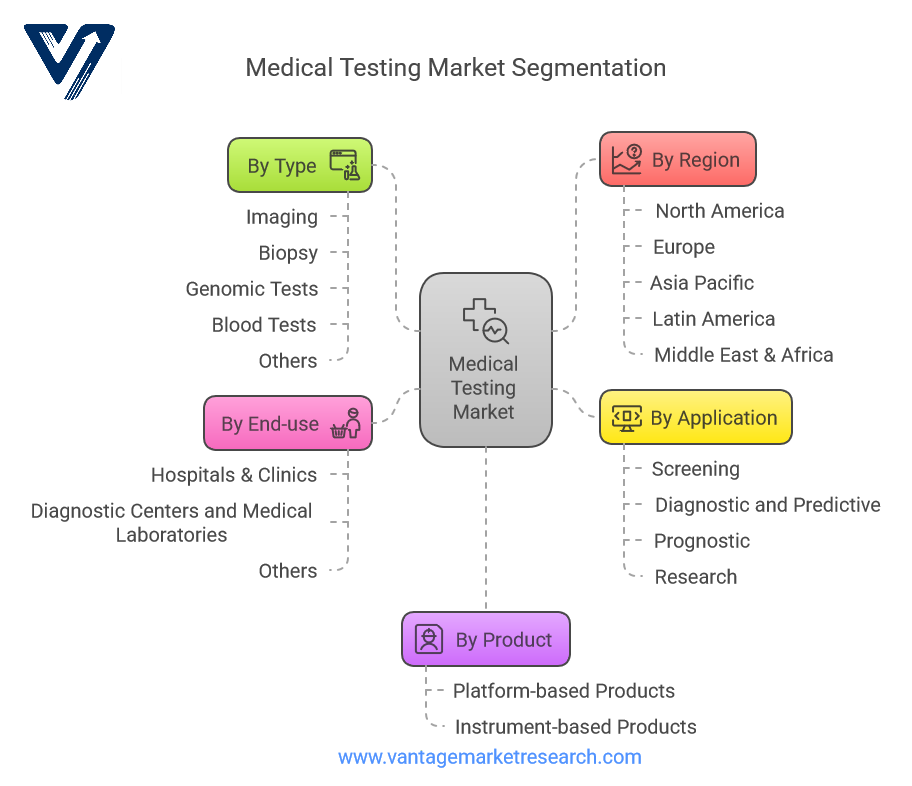

By Type

- Imaging

- Digital Mammography

- Digital Breast Tomosynthesis (3D Mammography)

- Ultrasound

- MRI

- Molecular Breast Imaging

- Others

The imaging segment dominates the market, with a 52.74% revenue share as of 2022. Digital breast tomosynthesis is gaining significant traction due to its ability to detect more cancers with lower recall rates than traditional mammography.

- Biopsy

- Needle Biopsy (Fine Needle Aspiration, Core Needle)

- Surgical Biopsy

- Vacuum-Assisted Biopsy

- Image-guided biopsy

Biopsy remains an essential confirmatory diagnostic procedure, but there is a growing preference for minimally invasive techniques that reduce patient discomfort and recovery time.

- Genomic Tests

- Oncotype DX

- MammaPrint

- EndoPredict

- PAM50 (Prosigna)

- Others

Genomic testing is experiencing rapid growth due to its ability to provide personalized insights for treatment decisions, particularly regarding the necessity of chemotherapy.

- Blood Tests

- CA 15-3

- CA 27.29

- CEA

- Circulating Tumor Cells

- Circulating Tumor DNA

- Others

Blood-based tests, particularly liquid biopsies, are gaining traction because they are noninvasive and can provide real-time monitoring of disease progression.

- Others

- Electrical Impedance Spectroscopy

- Breast Thermography

- Emerging Technologies

By Product

- Platform-based Products

- Automated Platforms

- Semi-automated Platforms

- Manual Platforms

Platform-based products are critical for high-throughput testing environments, offering efficiency and standardization in diagnostic procedures.

- Instrument-based Products

- Imaging Systems

- Biopsy Devices

- Reagents and Consumables

- Software and Services

The instrument-based product segment is driven by technological advancements in imaging and biopsy devices, with a growing focus on integration with artificial intelligence.

By Application

- Screening

- Routine Screening

- High-risk population Screening

- Supplemental Screening for Dense Breasts

Screening applications account for a significant portion of the market, and there is a growing emphasis on personalized screening approaches based on individual risk factors.

- Diagnostic and Predictive

- Initial Diagnosis

- Recurrence Detection

- Treatment Response Prediction

Diagnostic and predictive applications are increasingly utilizing advanced technologies to more accurately characterize breast cancers and predict treatment responses.

- Prognostic

- Disease Progression Monitoring

- Survival Prediction

- Recurrence Risk Assessment

Prognostic applications are benefiting from advancements in genomic and molecular technologies that provide deeper insights into disease behavior.

- Research

- Clinical Trials

- Academic Research

- Biomarker Discovery

- Technology Development

Research applications drive innovation in the field, with a growing focus on identifying novel biomarkers and developing next-generation diagnostic approaches.

By End-use

- Hospitals & Clinics

- Comprehensive Cancer Centers

- General Hospitals

- Specialized Breast Clinics

The hospitals & clinics segment dominates the market with a 50.6% revenue share as of 2022, driven by rising hospitalizations and the increasing burden of breast cancer.

- Diagnostic Centers and Medical Laboratories

- Reference Laboratories

- Specialized Breast Imaging Centers

- Pathology Laboratories

The diagnostic centers and medical laboratories segment is experiencing rapid growth due to increasing outsourcing of diagnostic services and the need for specialized expertise.

- Others

- Research Institutes

- Academic Centers

- Mobile Screening Units

- Telemedicine Providers

Other end-use settings are gaining importance, particularly for reaching underserved populations through mobile units and telemedicine services.

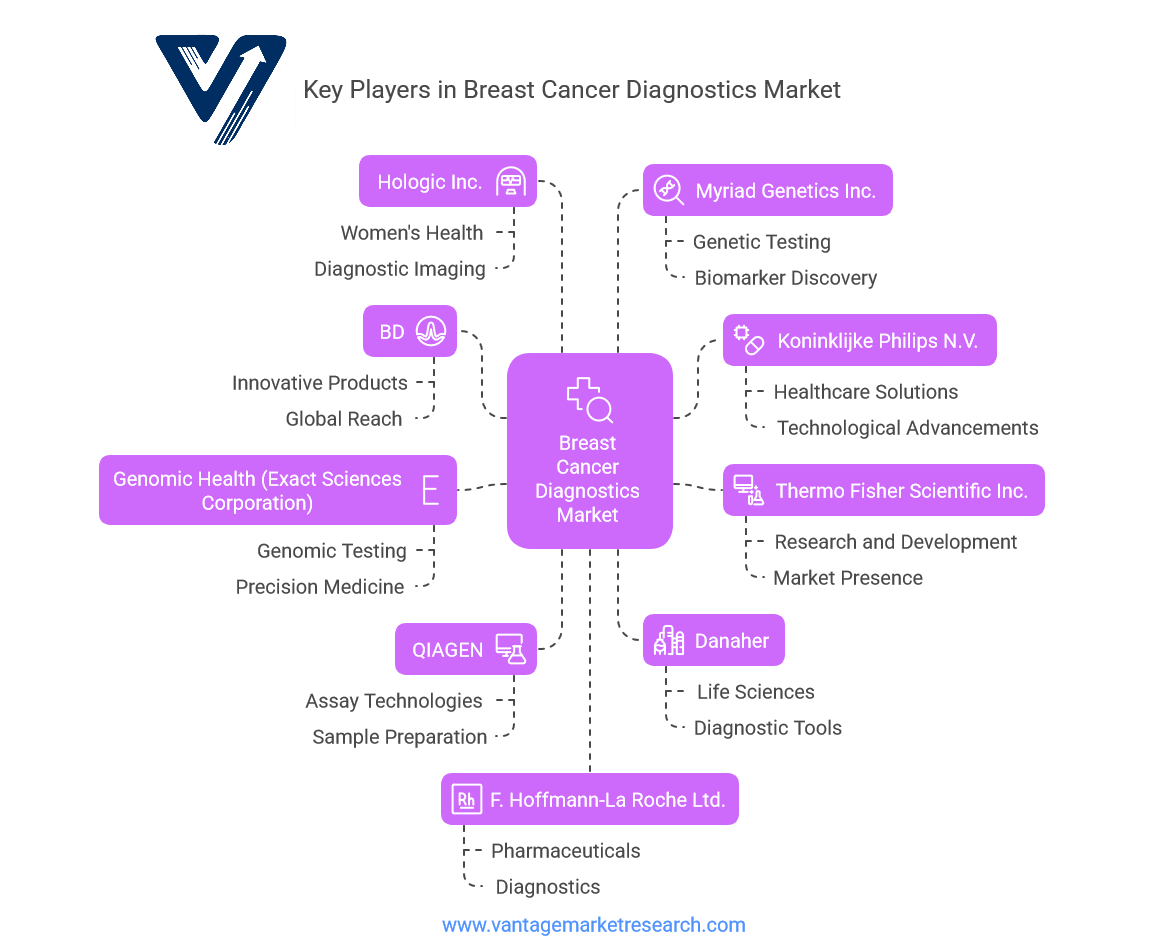

Top 12 Key Companies in Breast Cancer Diagnostics Market

The breast cancer diagnostics market features a mix of established medical device companies, specialized diagnostic firms, and emerging players focused on innovative technologies:

- Hologic, Inc.

- Market Position: Dominant player in the mammography market, controlling approximately 80% of the U.S. digital 3D mammography market.

- Key Products: 3Dimensions™ Mammography System, Genius AI® Detection Solution, Selenia® Dimensions® System

- Recent Developments: Launched advanced AI-powered breast cancer detection technology (Genius AI Detection 2.0) and presented research demonstrating its effectiveness across diverse populations.

- Koninklijke Philips N.V.

- Market Position: Leading provider of integrated breast imaging solutions

- Key Products: Breast Ultrasound Systems, MicroDose SI mammography system, IntelliSpace Breast

- Recent Developments: Enhanced its mammography and ultrasound portfolio with AI capabilities and improved integration with broader diagnostic workflows.

- Thermo Fisher Scientific Inc.

- Market Position: Leading provider of molecular diagnostic solutions

- Key Products: Oncomine Dx Target Test, cancer biomarker assays, NGS technologies

- Recent Developments: Partnered with Pfizer in May 2023 to expand the global accessibility of NGS-based cancer testing.

- Genomic Health (Exact Sciences Corporation)

- Market Position: Pioneer in genomic-based cancer diagnostics

- Key Products: Oncotype DX Breast Recurrence Score test, DCIS Score test

- Recent Developments: Continued to expand clinical validation of its tests, with a focus on guiding treatment decisions for early-stage HR-positive, HER2-negative breast cancer patients.

- QIAGEN

- Market Position: Leading provider of molecular diagnostic technologies

- Key Products: therascreen PIK3CA RGQ PCR Kit, AdnaTest BreastCancer, QIAseq Targeted DNA Human Breast Cancer Panel

- Recent Developments: Expanded its companion diagnostic portfolio, with a focus on liquid biopsy technologies and enhanced molecular testing capabilities.

- Danaher

- Market Position: Diversified healthcare company with a significant presence in breast cancer diagnostics

- Key Products: Mammotome breast biopsy devices, Leica Biosystems pathology solutions

- Recent Developments: Through its Mammotome subsidiary, expanded breast biopsy and localization technology offerings.

- Hologic Inc.

- Market Position: Leader in women's health diagnostics

- Key Products: Genius™ 3D Mammography™, Affirm® Prone Biopsy System, Brevera® Breast Biopsy System

- Recent Developments: Continued innovation in 3D mammography and AI-assisted detection technologies.

- Myriad Genetics Inc.

- Market Position: Specializes in genetic testing for hereditary cancer risk

- Key Products: MyRisk® Hereditary Cancer Test, BRACAnalysis CDx®

- Recent Developments: Partnered with SimonMed in April 2023 to develop a genetic cancer risk program focused on comprehensive risk assessment and personalized screening strategies.

- F. Hoffmann-La Roche Ltd.

- Market Position: Leading provider of in vitro diagnostics and companion diagnostics

- Key Products: PATHWAY HER2 (4B5) test, comprehensive breast cancer IHC/ISH portfolio, VENTANA HER2 Dual ISH test

- Recent Developments: Received FDA approval for the first companion diagnostic to identify patients with HER2-ultralow metastatic breast cancer eligible for targeted therapy (ENHERTU).

- Argon Medical Devices

- Market Position: Specialized provider of biopsy devices

- Key Products: BioPince® Ultra Full Core Biopsy Instrument, D Wire Breast Localization Needles

- Recent Developments: Enhanced its biopsy technology offerings with a focus on obtaining high-quality diagnostic tissue samples.

- Siemens Healthineers AG

- Market Position: Major player in medical imaging and diagnostics

- Key Products: Mammomat B.brilliant, advanced ultrasound systems for breast imaging

- Recent Developments: Introduced next-generation mammography systems with enhanced 3D image acquisition and reconstruction technology.

- GE Healthcare

- Market Position: Leading provider of medical imaging technologies

- Key Products: Invenia ABUS Premium (Automated Breast Ultrasound), MyBreastAI suite

- Recent Developments: Launched AI-driven, patient-friendly Invenia ABUS Premium to accelerate scanning and improve early cancer detection in dense breasts.

Recent Market Developments

AI Integration in Mammography (2025)

- The NHS launched the world's largest trial of AI breast cancer diagnosis, involving five different AI systems reading approximately 462,000 mammograms at 30 breast cancer screening centers.

- AI-supported double reading was associated with a 29% higher breast cancer detection rate without negatively affecting recall rates, according to a nationwide real-world implementation study.

Liquid Biopsy Advancements (2023-2025)

- Cancer Today's spring 2025 issue highlighted how liquid biopsy technologies are guiding treatment decisions for breast cancer patients.

- Studies demonstrated that liquid biopsies are more feasible and appropriate for ESR1+ breast cancer testing, offering quicker turnaround times compared to traditional tissue biopsies.

Strategic Partnerships and Collaborations (2023-2024)

- Thermo Fisher Scientific and Pfizer formed a strategic alliance in May 2023 to enhance the global accessibility of NGS-based cancer testing.

- Myriad Genetics and SimonMed collaborated in April 2023 on a genetic cancer risk program focused on comprehensive risk assessment and personalized screening strategies.

FDA Approvals (2024-2025)

- Roche received FDA approval for the first companion diagnostic (PATHWAY HER2 4B5 test) to identify patients with HER2-ultralow metastatic breast cancer eligible for targeted therapy.

- Several new diagnostic technologies received regulatory approvals, including Syantra's breast cancer test utilizing its Liquid Biopsy Platform, which received CE Mark approval in April 2023.

Product Launches (2023-2025)

- GE Healthcare launched the AI-driven Invenia ABUS Premium in 2025, designed to accelerate scanning and improve early cancer detection in dense breasts.

- Paige AI, Inc. introduced its AI-powered "Paige Breast Suite" in June 2023, enhancing pathologists' ability to detect and characterize breast cancers.

- Hologic presented new research in 2024 demonstrating how its breast imaging AI solution performs similarly across diverse populations, expanding its Genius AI Detection 2.0 solution.

Clinical Trial Initiatives (2022-2024)

- The American College of Radiology, in collaboration with GE Healthcare and the Breast Cancer Research Foundation, launched the Contrast-Enhanced Mammography Imaging Screening Trial (CMIST) in October 2022.

- Multiple clinical trials evaluating the effectiveness of AI in breast cancer detection showed promising results, with detection rate improvements ranging from 17.6% to 29% compared to traditional methods.

Genomic Testing Advancements (2024-2025)

- Reveal Genomics' HER2DX Assay demonstrated the ability to de-escalate early breast cancer treatment based on personalized genomic insights.

- New research published in 2025 showed how AI and genomics are personalizing cancer treatment, with researchers discovering 95 genes significantly associated with survival in cancers including breast cancer.

Digital Health Integration (2024-2025)

- The integration of breast cancer diagnostics with digital health platforms gained momentum, enabling seamless data sharing across care teams and improved patient engagement.

- Telemedicine solutions for remote interpretation of diagnostic results expanded, particularly benefiting underserved and rural populations.

Market Expansion in Emerging Economies (2024-2025)

- Significant investments in healthcare infrastructure in countries like China, India, and Brazil led to expanded access to advanced breast cancer diagnostic technologies.

- Public-private partnerships focused on increasing breast cancer awareness and screening programs in developing regions showed promising results in improving early detection rates.

Screening Guidelines Updates (2024-2025)

- Hologic responded to the U.S. Preventive Services Task Force's updated breast cancer screening guidelines in September 2023, emphasizing the importance of early detection and regular mammography screenings.

- Various professional organizations updated their screening recommendations based on new evidence regarding the benefits of earlier and more frequent screening, particularly for high-risk populations.

The Vantage Market Research report provides stakeholders valuable insights into the evolving breast cancer diagnostics landscape from 2025 to 2035. The market is characterized by rapid technological advancements, a growing emphasis on personalized medicine approaches, and increasing integration of artificial intelligence. As the global burden of breast cancer continues to rise, the diagnostic technologies market is expected to expand significantly, driven by the need for earlier detection, more accurate diagnosis, and personalized treatment approaches.

Browse More Health Care Industry News

The global Breast Imaging Market is valued at USD 5.68 Billion in 2024 and is projected to reach a value of USD 15.86 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 9.85% between 2025 and 2035.

The global Automated Breast Ultrasound System (ABUS) Market is valued at USD 262.2 Million in 2024 and is projected to reach a value of USD 1635 Million by 2035 at a CAGR (Compound Annual Growth Rate) of 18.15% between 2025 and 2035.

The global Breast Cancer Therapeutics Market is valued at USD 27.34 Billion in 2023 and is projected to reach a value of USD 55.18 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 8.12% between 2024 and 2032.

The global Breast Cancer Diagnostics Market is valued at USD 19.43 Billion in 2024 and is projected to reach a value of USD 45.83 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 8.10% between 2025 and 2035.

The Breast Biopsy Vacuum System Market Report provides an in-depth analysis of the market, offering valuable insights into market trends, technological advancements, and competitive intelligence across the Breast Biopsy Vacuum System sector.

FAQ.

- What is the current size of the breast cancer diagnostics market?

- What are the primary factors driving market growth?

- How is AI transforming breast cancer diagnostics?

- What role do liquid biopsies play in early detection?

- What advancements have been made in imaging technologies

- How is personalized medicine influencing diagnostics?

- What are the challenges facing the market?

- Which regions are experiencing significant market growth?

- What strategic initiatives are companies undertaking?

- What is the future outlook for the breast cancer diagnostics market?

Editor Details

-

Company:

- Vantage Market Research

-

Name:

- Rahul

- Email:

-

Telephone:

- +12129511369

Related Links

- Website: Breast Cancer Diagnostics Market