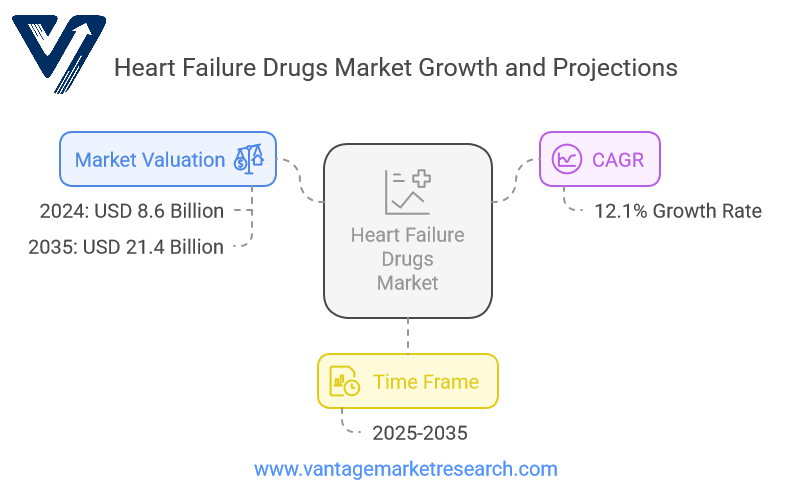

Analysis of Heart Failure Drugs Market Growth From USD 8.6 Billion in 2024 to USD 21.4 Billion by 2035

Market Overview of Heart Failure Drugs (2025–2035)

The Heart Failure Drugs Market is poised for a transformative decade between 2025 and 2035. As heart failure continues to pose a major global health challenge, the demand for effective therapeutic interventions is surging. The market, valued at approximately $8.6 billion in 2024, is projected to reach $21.4 billion by 2035, growing at a CAGR of 12.1%. Demographic trends, technological innovations, and evolving medical paradigms largely fuel this exponential growth.

The aging global population stands out as a pivotal driver. With people living longer and age being a significant risk factor for cardiovascular conditions, healthcare systems are witnessing a growing burden of chronic illnesses, including heart failure. Furthermore, lifestyle-related risk factors such as obesity, diabetes, and hypertension are also contributing to the increasing incidence of heart failure worldwide.

Another central growth enabler is the evolution of pharmacological science. Novel therapies with better safety profiles and superior efficacy continually enter the market, significantly enhancing patient outcomes and offering promising alternatives to traditional treatment regimens. Additionally, integrating digital health technologies, including wearable devices, AI-powered diagnostics, and telemedicine platforms, improves patient monitoring, compliance, and overall care delivery.

Governments and private healthcare providers are also playing a crucial role by investing in awareness campaigns, early screening programs, and healthcare infrastructure, particularly in developing regions. These efforts contribute to earlier diagnosis and more aggressive treatment of heart failure, thereby boosting the market.

Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.vantagemarketresearch.com/heart-failure-drugs-market-3922/request-sample

Looking ahead, three significant trends are expected to shape the market trajectory:

- Personalized Medicine: Treatments tailored to a patient's genetic and biological profile are gaining traction, promising more effective and less toxic therapies.

- Combination Therapies: Multifaceted treatment regimens involving multiple drug classes are increasingly used to manage heart failure's complex pathophysiology.

- Value-Based Care Models: Payers and providers are shifting from volume-based to outcome-based care, emphasizing patient health outcomes and long-term benefits.

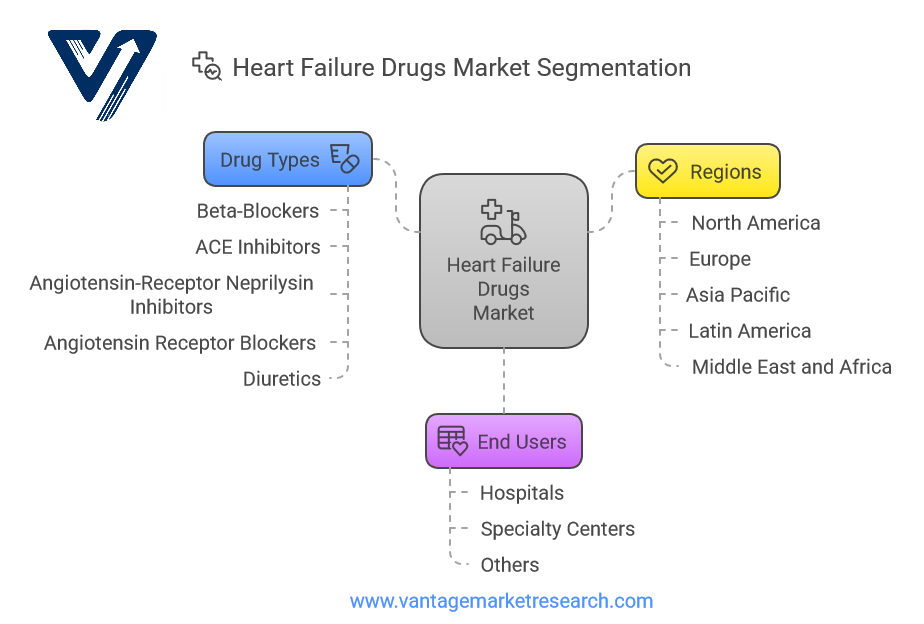

Key Drug Classes and Their Impact

- Beta-Blockers

- ACE Inhibitors

- Angiotensin-Receptor Neprilysin Inhibitors

- Angiotensin Receptor Blockers

- Diuretic

The heart failure drug landscape comprises several key drug classes, each with distinct mechanisms of action and therapeutic roles. These include ACE Inhibitors, Beta-Blockers, Diuretics, ARNI (Angiotensin Receptor-Neprilysin Inhibitors), and SGLT2 Inhibitors.

ACE Inhibitors, such as enalapril and lisinopril, have long served as a cornerstone in heart failure management. These agents reduce angiotensin II levels, leading to vasodilation and decreased blood pressure, thereby improving heart function. However, side effects like persistent cough and angioedema can limit their use in certain populations.

Beta-blockers, such as carvedilol and metoprolol, are vital in reducing cardiac workload and improving survival rates. They are especially beneficial post-myocardial infarction but require gradual dose titration to prevent bradycardia or hypotension.

Diuretics, including furosemide and hydrochlorothiazide, remain essential for symptomatic relief. By reducing fluid overload, they alleviate symptoms like edema and dyspnea. However, they offer minimal impact on disease progression and carry risks such as electrolyte imbalance.

ARNIs, notably sacubitril/valsartan, represent a breakthrough in heart failure therapy. Combining neprilysin inhibition with angiotensin receptor blockade offers dual benefits in symptom relief and disease modification. Despite their effectiveness, their relatively high cost remains a barrier in certain markets.

SGLT2 Inhibitors, initially developed for diabetes, have emerged as game changers in heart failure management. Drugs like empagliflozin and dapagliflozin show robust evidence in reducing hospitalizations and cardiovascular death, even in non-diabetic populations. As their long-term effects continue to be studied, they are rapidly incorporated into clinical guidelines.

Recent innovations also focus on extended-release formulations and fixed-dose combinations, which improve medication adherence and simplify complex regimens. This is a crucial advantage in managing elderly, comorbid patient populations.

Take Action Now: Secure Your Position in the Global Heart Failure Drugs Industry Today – Purchase Now.

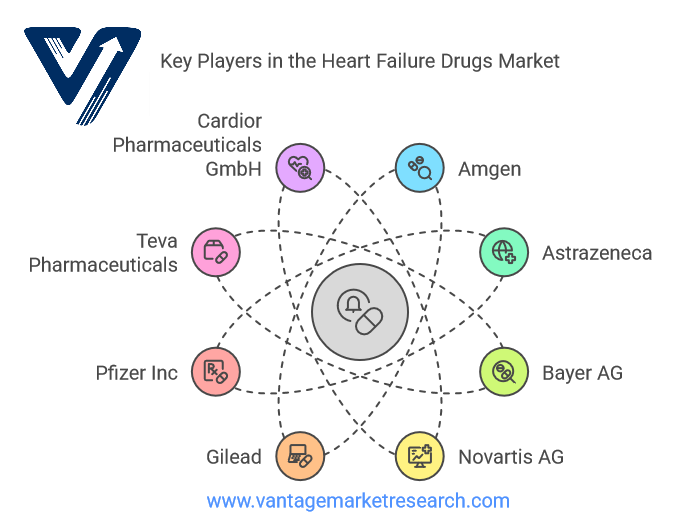

Top 11 Leading Pharmaceutical Companies in the Heart Failure Industry

- Amgen

- Astrazeneca

- Bayer AG

- Novartis AG

- Gilead

- Pfizer Inc

- Teva Pharmaceuticals

- Cardior Pharmaceuticals GmbH

- GlaxoSmithKline

- Bristol-Myers Squibb Company

- Eli Lilly and Company

Several global pharmaceutical giants are leading the development of heart failure drugs. Novartis, Bristol-Myers Squibb, Merck & Co., Pfizer, and Bayer AG are key players. These companies dominate through research excellence, strategic alliances, and global market presence.

Novartis's flagship ARNI product, Entresto, has redefined treatment standards. The company continues to invest in expanding indications and next-generation formulations.

Bristol-Myers Squibb and Merck & Co. are exploring novel biologics and anti-inflammatory agents targeting the underlying causes of heart failure, particularly in heart failure with preserved ejection fraction (HFpEF), a historically underserved segment.

Pfizer has strengthened its cardiovascular portfolio through acquisitions and co-development deals, while Bayer AG continues to expand its reach through innovative SGLT2 inhibitors and collaborative research projects.

Major strategies employed by these firms include:

- Heavy investment in R&D: Often over 15% of annual revenues.

- Partnerships with biotech firms: To access breakthrough technologies and diversify pipelines.

- Geographic expansion: Especially into Asia Pacific, Latin America, and the Middle East.

Recent high-profile collaborations include Novartis’s partnership with small-cap biotech firms working on gene therapies and Bayer’s acquisition of cardiovascular startups focused on next-gen inhibitors.

Regional Market Insights

- North America

- U.S.

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

North America, particularly the U.S., continues to lead the heart failure drugs market, supported by robust healthcare infrastructure, advanced research institutions, and a high prevalence of lifestyle diseases. Government initiatives like Medicare support using newer, higher-cost therapies, further fueling growth.

Europe follows closely, with countries like Germany, France, and the UK investing heavily in chronic disease management. The European Medicines Agency (EMA) has proactively approved innovative heart failure drugs, accelerating market penetration.

Asia Pacific is expected to witness the fastest CAGR through 2035. The region is characterized by a large population base, increasing healthcare spending, and a growing burden of heart disease. Countries like China and India focus on improving healthcare access and affordability, creating fertile ground for heart failure drug adoption.

Latin America and the Middle East & Africa (MEA), while still developing in terms of infrastructure, are showing increasing demand due to improved health literacy and the proliferation of generic drug manufacturing.

Distribution Channels and Their Dynamics

- Hospitals

- Specialty Center

- Others

Heart failure drugs are predominantly distributed through retail pharmacies, hospital pharmacies, and online platforms.

Retail pharmacies dominate due to their widespread presence and ease of access. These channels are especially important in chronic disease management where prescription refills are frequent.

Online pharmacies are gaining momentum, especially in urban areas and developed countries. They offer competitive pricing, home delivery, and medication management tools, making them attractive to tech-savvy patients.

Hospital pharmacies play a critical role, especially in acute care settings. Post-discharge, they ensure continuity of care by providing starter packs and facilitating early treatment adherence.

Hybrid models involving direct-to-patient shipping and subscription-based medication delivery services are also emerging, further transforming the distribution landscape.

For the Heart Failure Drugs Market Research Report and updates, view the full report now!

Innovations and Future Directions

Disruptive innovations in drug development and patient care strategies are shaping the future of heart failure treatment.

Breakthrough therapies under development include gene-editing tools (e.g., CRISPR-based interventions), anti-inflammatory biologics, and agents targeting myocardial fibrosis. Several Phase II and III clinical trials are showing promise, particularly for HFpEF and rare cardiomyopathies.

Technological integration is revolutionizing the R&D landscape. Big data analytics, AI-based modeling, and digital twins are accelerating drug discovery timelines and improving trial outcomes.

Personalized medicine is becoming a central focus. Genomic screening, biomarker analysis, and real-time data monitoring enable tailored treatment plans that maximize efficacy while minimizing adverse effects.

The convergence of pharmacology, technology, and patient-centric care is positioning the heart failure drugs market for a decade of unprecedented innovation and impact.

Conclusion

From 2025 to 2035, the heart failure drugs market is on track to nearly triple in size. This growth is underpinned by a convergence of demographic shifts, technological progress, and evolving healthcare ecosystems. As new therapies and precision medicine gain traction, stakeholders—including investors, healthcare providers, and regulators—must stay attuned to emerging trends and innovations. Success in this dynamic market will hinge on adaptability, innovation, and a deep understanding of scientific and patient needs.

FAQs

- What factors are driving the growth of the Heart Failure Drugs Market?

- How does the Compound Annual Growth Rate (CAGR) of 12.1% impact the market predictions for heart failure drugs?

- What are the key trends shaping the Heart Failure Drugs Market between 2025 and 2035?

- How is the valuation of the Heart Failure Drugs Market expected to change from 2024 to 2035?

- What are the key trends influencing the Heart Failure Drugs Market from 2025 to 2035?

- What are the major segments within the Heart Failure Drugs Market?

Browse More Health Care Industry News

The global Prosthetic Heart Valve Market is valued at USD 8.74 Billion in 2024 and is projected to reach a value of USD 28.96 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 11.55% between 2025 and 2035.

The Diastolic Heart Failure Drug Market Report provides an in-depth analysis of the market, offering valuable insights into market trends, technological advancements, and competitive intelligence across the Diastolic Heart Failure Drug sector.

The global Heart Valve Devices Market is valued at USD 12.18 Billion in 2024 and is projected to reach a value of USD 41.88 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 11.95% between 2025 and 2035.

The global Heart Failure POC & LOC Devices Market is valued at USD 102.3 Million in 2024 and is projected to reach a value of USD 481 Million by 2035 at a CAGR (Compound Annual Growth Rate) of 15.15% between 2025 and 2035.

The global Structural Heart Devices Market is valued at USD 13.1 Billion in 2024 and is projected to reach a value of USD 35.65 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 9.55% between 2025 and 2035.

Editor Details

-

Company:

- Vantage Market Research

-

Name:

- Rahul

- Email:

-

Telephone:

- +12129511369

Related Links

- Website: Heart Failure Drugs Market