Insights Into The Hepatitis C Drug Market Growth Projections From 2024 To 2035

Premium Insights

The Hepatitis C drug market is entering a transformative phase as global health organizations, pharmaceutical companies, and governments ramp up their efforts to combat this chronic and often silent disease. Hepatitis C, a liver infection caused by the Hepatitis C virus (HCV), affects an estimated 58 million people worldwide, according to the World Health Organization (WHO). While curative treatments exist, especially in direct-acting antivirals (DAAs), accessibility, affordability, and diagnosis gaps remain persistent global challenges. From 2025 to 2035, the market is expected to evolve significantly, shaped by innovation, policy, and demographic shifts.

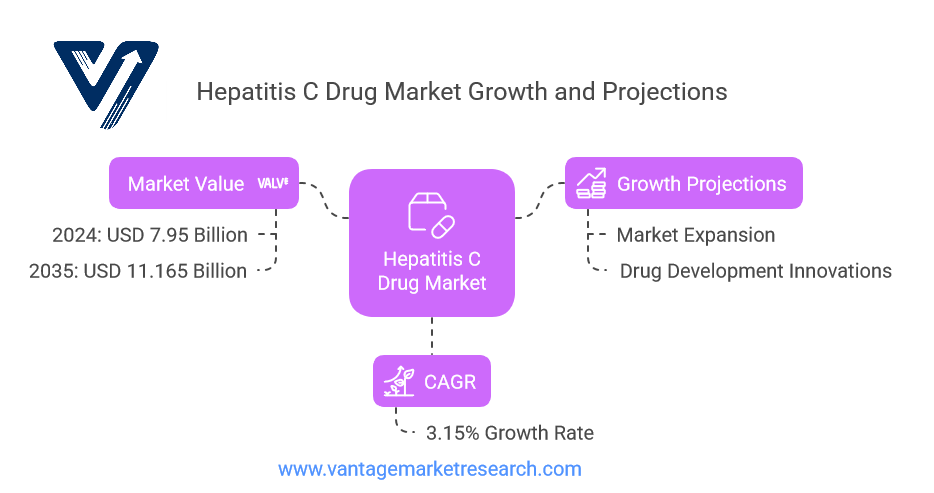

Between 2025 and 2035, the Hepatitis C drug market is expected to grow at a moderate but steady pace, reaching an estimated $11.165 billion by 2035. This projection is underpinned by a compound annual growth rate (CAGR) of 3.15% from 2024 onward. Though this growth rate is not explosive, it reflects a resilient and adapting market, especially considering the disease's prevalence in underserved populations and the growing focus on public health equity.

Innovation in treatment protocols and expanded screening efforts are major market stimulators. The emergence of more affordable generics and all-oral regimens has increased the feasibility of mass treatment initiatives, especially in countries with previously limited access. Concurrently, robust awareness campaigns are helping destigmatize the disease and encourage testing, particularly among high-risk groups.

Regionally, North America is expected to maintain its leadership position, driven by a well-developed healthcare infrastructure and widespread insurance coverage. In contrast, Asia Pacific will likely experience the highest growth rate, propelled by increasing infection rates, governmental health reforms, and expanded access to medication. Europe’s market growth, while positive, will be tempered by regulatory complexity and heterogeneity across national healthcare systems.

The Hepatitis C drug market remains a critical segment within the broader infectious disease pharmaceutical industry. With rising demand for effective and accessible treatment, increasing awareness, and advancing medical technology, the sector is poised for steady evolution over the next decade.

Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.vantagemarketresearch.com/hepatitis-c-drug-market-2239/request-sample

Key Drivers Influencing Market Expansion

A series of compelling factors are converging to drive the global expansion of the Hepatitis C drug market from 2025 through 2035. These drivers are multifaceted, encompassing everything from shifting disease epidemiology to the rise of pharmaceutical innovation.

Increasing Awareness and Early Detection

The global push toward early detection and disease awareness is one of the most significant growth factors. Governments, NGOs, and health organizations have invested in public health campaigns aimed at encouraging people—especially those in high-risk groups such as intravenous drug users, individuals with HIV, and baby boomers—to get tested. As more individuals are diagnosed, the demand for curative drug therapies rises correspondingly.

Pharmaceutical Innovation and New Treatment Regimens

Over the last decade, direct-acting antivirals (DAAs) have revolutionized the treatment of Hepatitis C, offering cure rates above 95% with shorter treatment durations and fewer side effects. Pharmaceutical companies are continuously working to improve these formulations. For example, pan-genotypic therapies that can treat all major HCV strains with one combination have become increasingly prevalent, making treatment more streamlined and accessible.

Government and Global Health Initiatives

Initiatives such as the WHO’s goal to eliminate viral hepatitis as a major public health threat by 2030 have spurred substantial governmental and international funding. Countries are expanding screening programs, subsidizing medication costs, and incorporating Hepatitis C treatments into national healthcare plans. Global partnerships have emerged in developing regions to reduce drug prices and enhance supply chain efficiency.

Growing Healthcare Investments in Emerging Markets

Rapid economic development and healthcare reform in countries like India, China, and Brazil are expanding access to diagnostics and treatments. As public and private sectors invest more in healthcare infrastructure, more patients gain access to life-saving Hepatitis C medications, fueling market growth.

Expansion of Generic Drug Availability

With several key patents set to expire over the next decade, the introduction of generic versions of effective DAAs is expected to significantly lower treatment costs. This will make medication accessible to millions previously priced out of the market, especially in low- and middle-income countries.

These drivers are creating a fertile environment for sustained growth in the Hepatitis C drug market over the coming decade.

Take Action Now: Secure Your Position in the Global Hepatitis C Drug Industry Today – Purchase Now.

Market Challenges and Limitations

Despite the optimistic forecast, the Hepatitis C drug market faces several formidable challenges that could hinder its full growth potential over the next ten years. These challenges are especially pronounced in under-resourced regions and may affect pricing, distribution, and overall treatment success.

High Treatment Costs

Perhaps the most significant limitation is the high cost of Hepatitis C drugs, particularly in high-income countries. While DAAs are revolutionary in their effectiveness, some branded treatments can cost tens of thousands of dollars per course, posing a significant burden to healthcare systems and uninsured patients. Although generic alternatives are gradually entering the market, price sensitivity remains a key barrier to wider adoption.

Access Disparities in Low-Income Regions

Limited access to healthcare infrastructure in many developing nations continues to restrict the market’s reach. In Sub-Saharan Africa and parts of Southeast Asia, a lack of diagnostic services, a shortage of healthcare professionals, and weak distribution channels hinder effective treatment rollout. As a result, many infected individuals remain undiagnosed or untreated.

Social Stigma and Lack of Awareness

In many parts of the world, social stigma associated with Hepatitis C—often linked with drug use or sexual transmission—deters individuals from getting tested or seeking treatment. Education and awareness campaigns must intensify to overcome these cultural and societal barriers.

Regulatory and Legal Challenges

Complex regulatory landscapes, particularly in the European Union and some Asian countries, delay the approval and introduction of new therapies. Additionally, stringent pricing regulations and reimbursement limitations affect the marketability and profitability of high-end treatments.

Risk of Drug Resistance

While rare, drug-resistant Hepatitis C strains could pose a future challenge. Continued surveillance and R&D investment are essential to anticipate and respond to potential viral mutations that may render current therapies less effective.

Addressing these challenges will be crucial for realizing the full potential of the Hepatitis C drug market between 2025 and 2035.

For the Hepatitis C Drug Market Research Report and updates, view the full report now!

Insights by Drug Class and Distribution Channels

The Hepatitis C drug market is complex and multi-layered, structured around distinct drug classes, delivery methods, and treatment settings. Understanding these dynamics is vital for stakeholders aiming to identify opportunities and formulate strategic plans.

Drug Class Segmentation

Several key drug classes form the market’s backbone:

- Direct-acting antivirals (DAAs) are the most dominant category due to their high cure rates and tolerability. Drugs like sofosbuvir and ledipasvir fall into this category and have reshaped the treatment landscape.

- Interferon-Based Therapies: These are now largely outdated due to side effects and lower efficacy, but they are still in limited use where newer options are unavailable.

- NS5A Inhibitors and Protease Inhibitors: Often used in combination therapies to enhance efficacy.

- Fixed-dose combinations (FDCs) improve compliance by reducing pill burden and treatment duration.

- Other Products include supportive care medications, developing vaccines, and emerging biologics.

Distribution Channels

Three main distribution channels dominate treatment delivery:

- Hospitals: These settings account for the largest revenue share, especially in countries where national health programs administer treatment directly.

- Retail Pharmacies: Widely used in North America and Europe, offering easier access to DAAs with prescriptions.

- Online Pharmacies: A growing segment, especially in regions with established digital infrastructure and remote patient care models.

By Disease Type

- Acute Hepatitis C: This segment is smaller due to spontaneous viral clearance in some patients, yet it is important for early intervention strategies.

- Chronic Hepatitis C is the largest market segment, with ongoing treatment needs and a higher demand for monitoring and management solutions.

Emerging Trends in Drug Delivery

Advancement in delivery methods—such as long-acting injectables and dissolvable oral films—enhances patient adherence. Telemedicine-based prescription models and digital tracking of treatment outcomes are also gaining traction.

Regional Market Dynamics

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The global Hepatitis C drug market is shaped by diverse regional dynamics that reflect economic capacity, healthcare infrastructure, and disease prevalence.

North America

North America, particularly the United States, leads the global market in terms of revenue. The region benefits from advanced healthcare systems, strong insurance coverage, and high early diagnosis and treatment rates. Major pharmaceutical companies headquartered in the U.S. dominate R&D and commercialization efforts. Aggressive awareness campaigns have also driven testing rates, especially among the aging population.

Asia Pacific

This region is poised for the fastest growth through 2035, driven by several factors: the rising prevalence of Hepatitis C, improving healthcare systems, and expanding access to generic medications. Countries like India and China are investing heavily in public health infrastructure and have strong pharmaceutical manufacturing capabilities, positioning them as key players in affordable treatment access.

Europe

The European market is characterized by steady but moderate growth. National healthcare systems vary significantly in reimbursement and pricing policies, which can delay or restrict drug availability. However, strong regulatory agencies like the EMA ensure high-quality treatment options, and large-scale public health programs in countries like France and Germany contribute to improved diagnosis and treatment rates.

Latin America and Middle East & Africa

Latin America, the Middle East, and Africa remain under-penetrated but increasingly important markets. Governments in countries such as Brazil and Egypt have launched aggressive elimination programs, with Egypt already making significant strides in population-wide screening and treatment. While burdened by poor infrastructure, Sub-Saharan Africa offers untapped potential if access to affordable therapies is improved.

Competitive Landscape

The Hepatitis C drug landscape is highly competitive, with several global players vying for market share. Gilead Sciences Inc. and AbbVie Inc. are market leaders known for their high-performing DAA regimens. Bristol-Myers Squibb, Merck, and Janssen Pharmaceuticals maintain strong portfolios supported by global distribution and R&D capabilities.

European pharma giants like Roche, Novartis, and Sanofi are focusing on biosimilars and next-gen therapeutics. Meanwhile, generic manufacturers such as Mylan, Teva, and Cipla are becoming increasingly relevant, especially in emerging markets.

Recent innovations include the development of once-daily combination pills, therapies targeting genotype-specific resistance, and injectable long-acting DAAs. Companies collaborate with academic institutions and governments to accelerate research and expand access.

Strategic alliances—such as Gilead’s licensing deals for generics in developing countries—exemplify collaboration's role in shaping the market's future.

The top 17 Prominent players in the Hepatitis C drug market include:

- AbbVie Inc. (U.S.)

- Gilead Sciences Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Janssen Pharmaceuticals Inc. (Belgium)

- Merck Sharp & Dohme Corp. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Vertex Pharmaceuticals Inc. (U.S.)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Roche Holding AG (Switzerland)

- GlaxoSmithKline PLC (UK)

- Mylan N.V. (U.S.)

- Eli Lilly and Company (U.S.)

- Bayer AG (Germany)

- AstraZeneca PLC (UK)

- Sanofi S.A. (France)

- Teva Pharmaceutical Industries Ltd. (Israel)

Future Outlook for Hepatitis C Drug Treatments

The future of the Hepatitis C drug market looks optimistic, with a strong focus on accessibility, innovation, and affordability. Drug approvals for advanced DAA regimens with fewer side effects and broader genotype coverage are expected to increase. Moreover, therapies targeting co-infections (like HIV/HCV) will become more prevalent as pharmaceutical companies explore integrated solutions for complex patient needs.

The expiration of key patents by 2027–2029 will open the door for generic versions of high-cost drugs, making treatment accessible to a broader demographic. Generic competition will likely lower prices, driving growth in low- and middle-income countries.

R&D will remain the backbone of this market, especially with the possibility of a Hepatitis C vaccine still under investigation. Research into host-targeted therapies, resistance management, and real-world effectiveness will be central to ensuring long-term sustainability and patient-centered care.

In conclusion, the Hepatitis C drug market is at a pivotal moment. With strategic investments, global collaborations, and policy alignment, the industry can overcome existing barriers and make transformative progress over the next decade.

FAQ.

- What factors are driving the growth of the Hepatitis C Drug Market?

- How is the CAGR of 3.15% significant for the Hepatitis C Drug Market's future?

- What are the expected challenges for the Hepatitis C Drug Market between 2025 and 2035?

- Which regions are anticipated to contribute most to the Hepatitis C Drug Market's growth by 2035?

- How is the Hepatitis C Drug Market expected to change from 2024 to 2035?

Browse More Health Care Industry News

The Hepatitis B Virus Core Antibody Detection Kit Market Report provides an in-depth analysis of the market, offering valuable insights into market trends, technological advancements, and competitive intelligence across the Hepatitis B Virus Core Antibody Detection Kit sector.

The global Non Alcoholic Steatohepatitis (NASH) Market is valued at USD 7.48 Billion in 2024 and is projected to reach a value of USD 72.08 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 22.95% between 2025 and 2035.

The global Oncolytic Virus Immunotherapy Market is valued at USD 32.8 Billion in 2024 and is projected to reach a value of USD 399 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 25.55% between 2025 and 2035.

The Adeno-Associated Virus (AAV) Gene Therapy Market Report provides an in-depth analysis of the market, offering valuable insights into market trends, technological advancements, and competitive intelligence across the Adeno-Associated Virus (AAV) Gene Therapy sector.

The global Adeno-associated Virus (AAV) Vector-based Gene Therapy Market is valued at USD 6.02 Billion in 2024 and is projected to reach a value of USD 33.56 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 17.1% between 2025 and 2035.

Editor Details

-

Company:

- Vantage Market Research

-

Name:

- Rahul

- Email:

-

Telephone:

- +12129511369

Related Links

- Website: Hepatitis C Drug Market